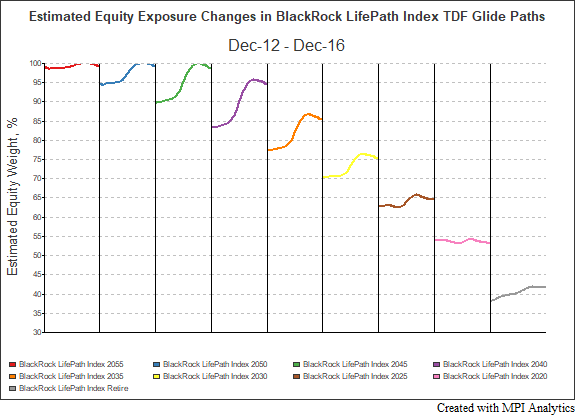

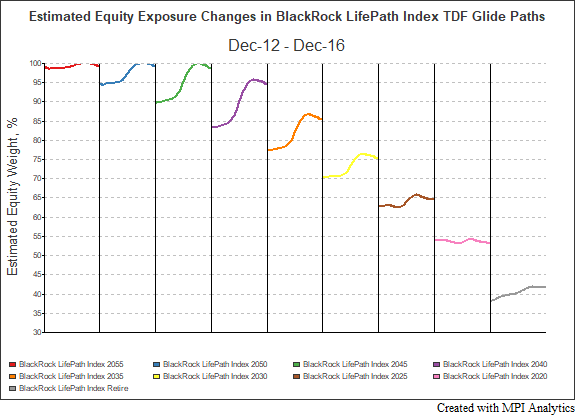

Morningstar’s 2017 Target Date Landscape Report indicates that approximately one quarter of TDF series shifted the target equity allocation of at least one vintage by 15% or more over the last 5 years and nearly half by at least 5%.

Morningstar’s 2017 Target Date Landscape Report indicates that approximately one quarter of TDF series shifted the target equity allocation of at least one vintage by 15% or more over the last 5 years and nearly half by at least 5%.

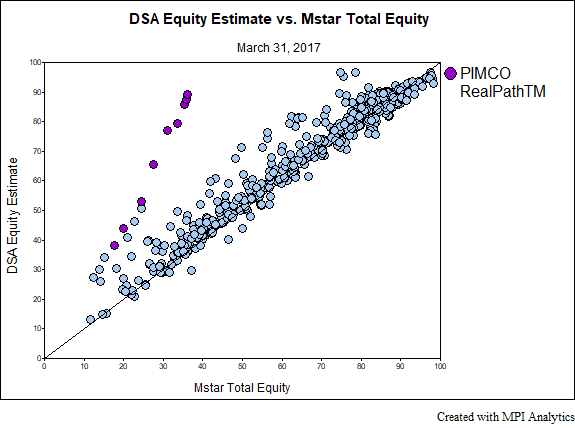

Four of the other five fund families with holdings vs. returns-based discrepancies are of a similar nature in that they have investments in derivatives, leveraged funds or absolute return funds, which affect the holdings tally. In each of these cases, DSA provides a much closer estimate to the intended systematic exposure.

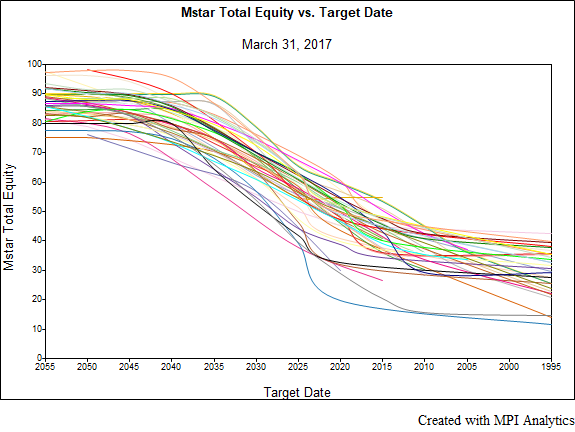

We demonstrate the advantages of using returns-based analysis in determining the effective glide-paths of Target-Date Funds vs. the stated ones