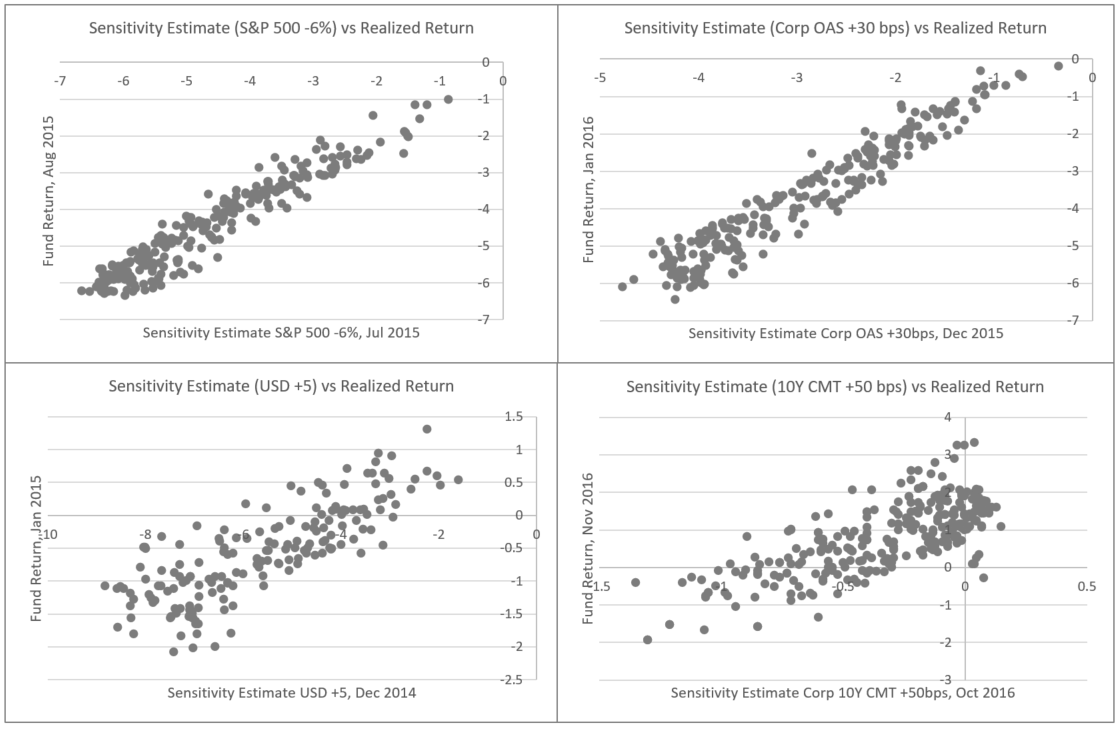

In this post, our research team demonstrates a clever way to backtest forward-looking scenarios commonly used in portfolio risk analysis.

In this post, our research team demonstrates a clever way to backtest forward-looking scenarios commonly used in portfolio risk analysis.

“Rather than seek alpha from an outstanding hedge fund or private equity manager, target-date investors would be better off embracing diversification by adding more asset classes,” explains Jeff Schwartz, president at MPI. “Those benefits could probably be accessed at lower cost from the liquid alternative universe, or in ETFs that replicate hedge fund strategies.” Read the full article here.

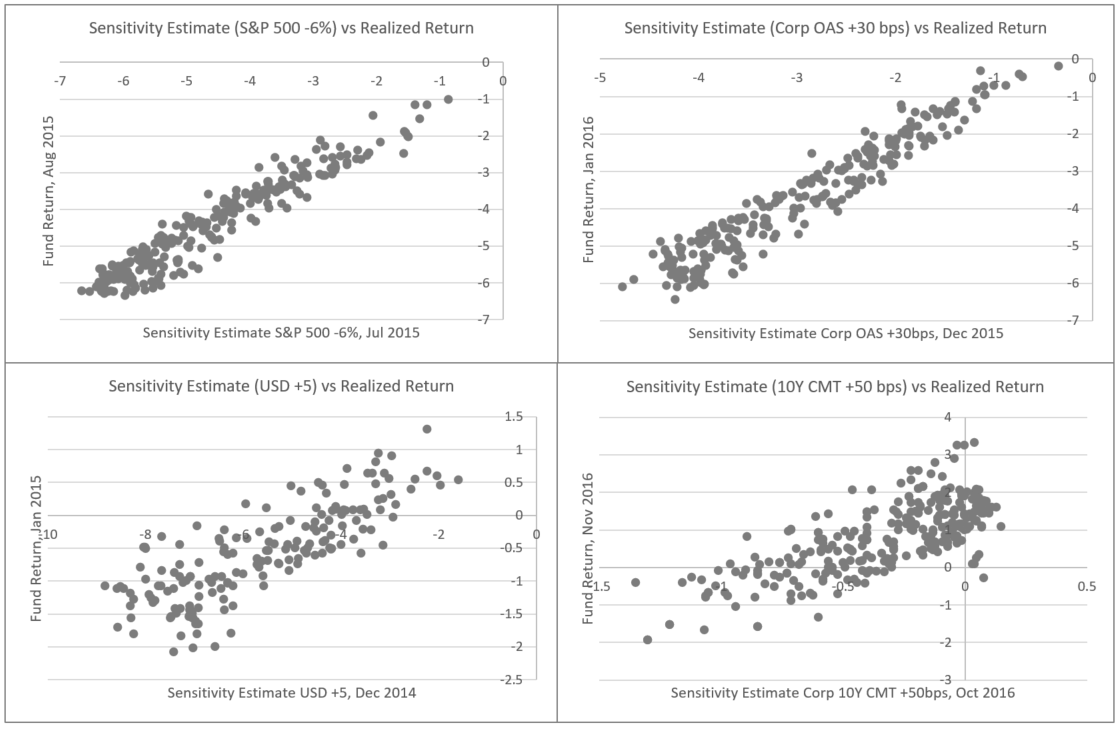

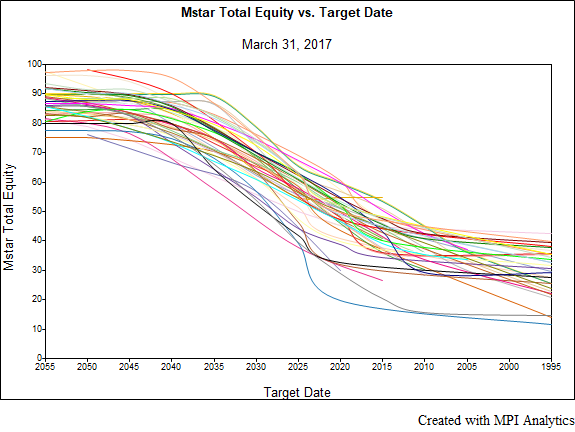

Morningstar’s 2017 Target Date Landscape Report indicates that approximately one quarter of TDF series shifted the target equity allocation of at least one vintage by 15% or more over the last 5 years and nearly half by at least 5%.

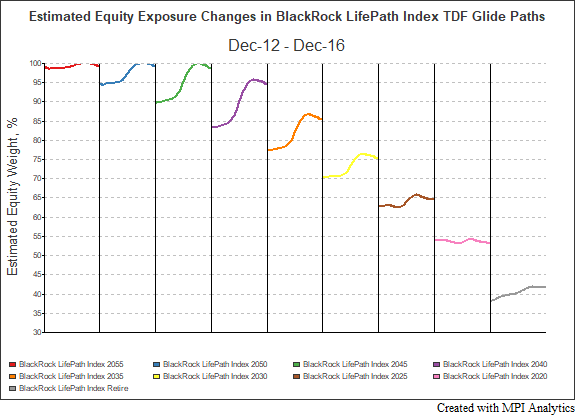

Four of the other five fund families with holdings vs. returns-based discrepancies are of a similar nature in that they have investments in derivatives, leveraged funds or absolute return funds, which affect the holdings tally. In each of these cases, DSA provides a much closer estimate to the intended systematic exposure.

We demonstrate the advantages of using returns-based analysis in determining the effective glide-paths of Target-Date Funds vs. the stated ones