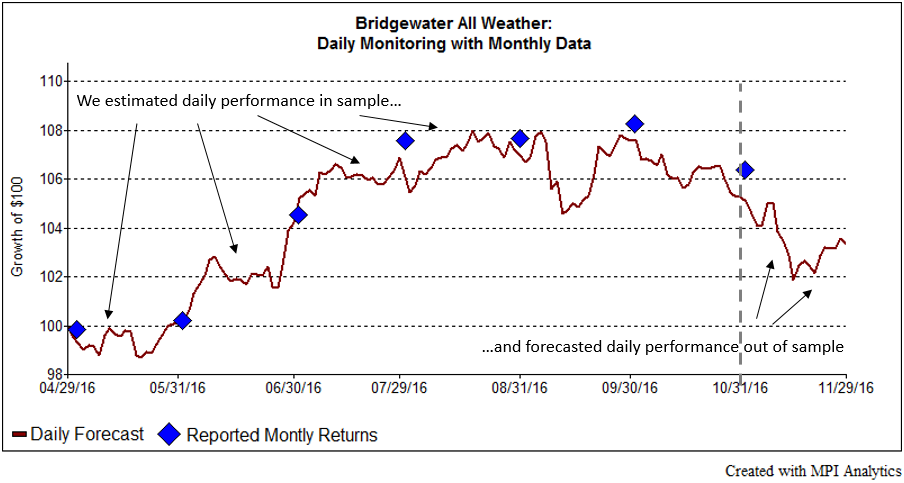

Keep Risk Parity Simple Stupid

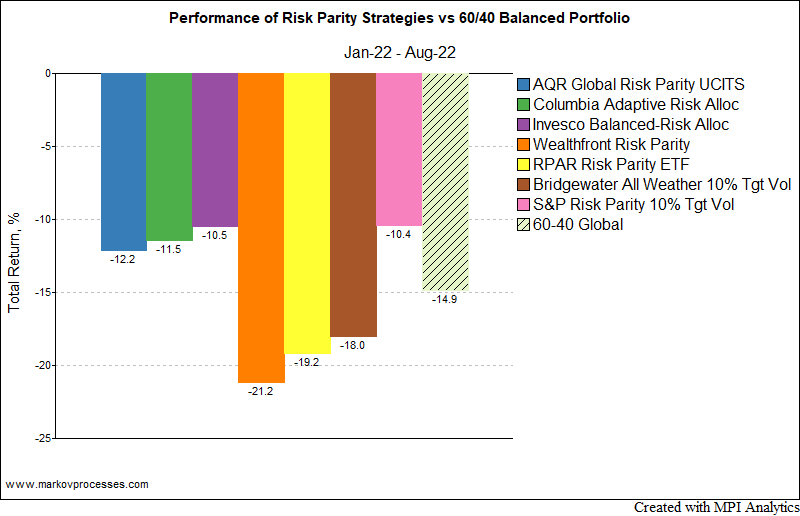

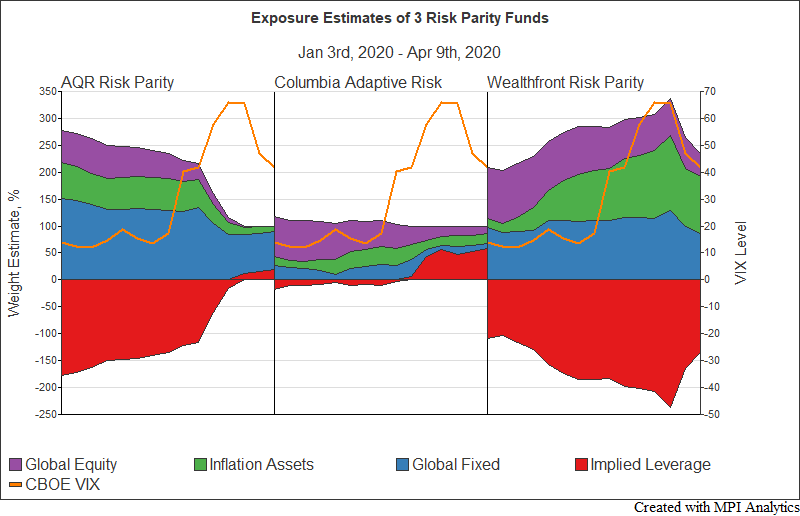

2022 has been a challenging year for some of the largest risk-parity funds. RISK.net’s Luke Clancy covers MPI research “Is 2022 All Bad Weather For Risk Parity?” in his article Keep risk parity simple, stupid – Risk.net (subscription required)