This document provides an introduction to MPI portfolio stress testing methodology as well as a step-by-step overview of how to conduct fund- and portfolio-level stress tests within the MPI Stylus Pro application.

This document provides an introduction to MPI portfolio stress testing methodology as well as a step-by-step overview of how to conduct fund- and portfolio-level stress tests within the MPI Stylus Pro application.

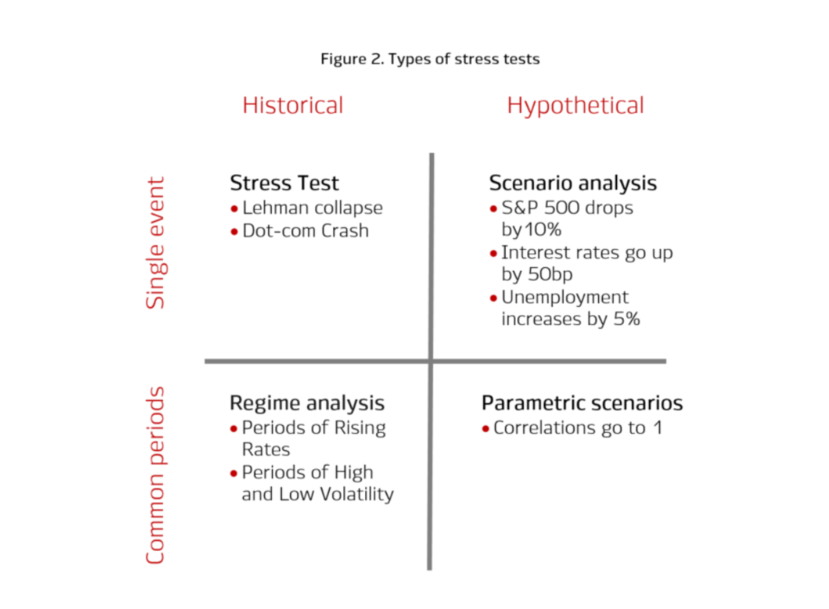

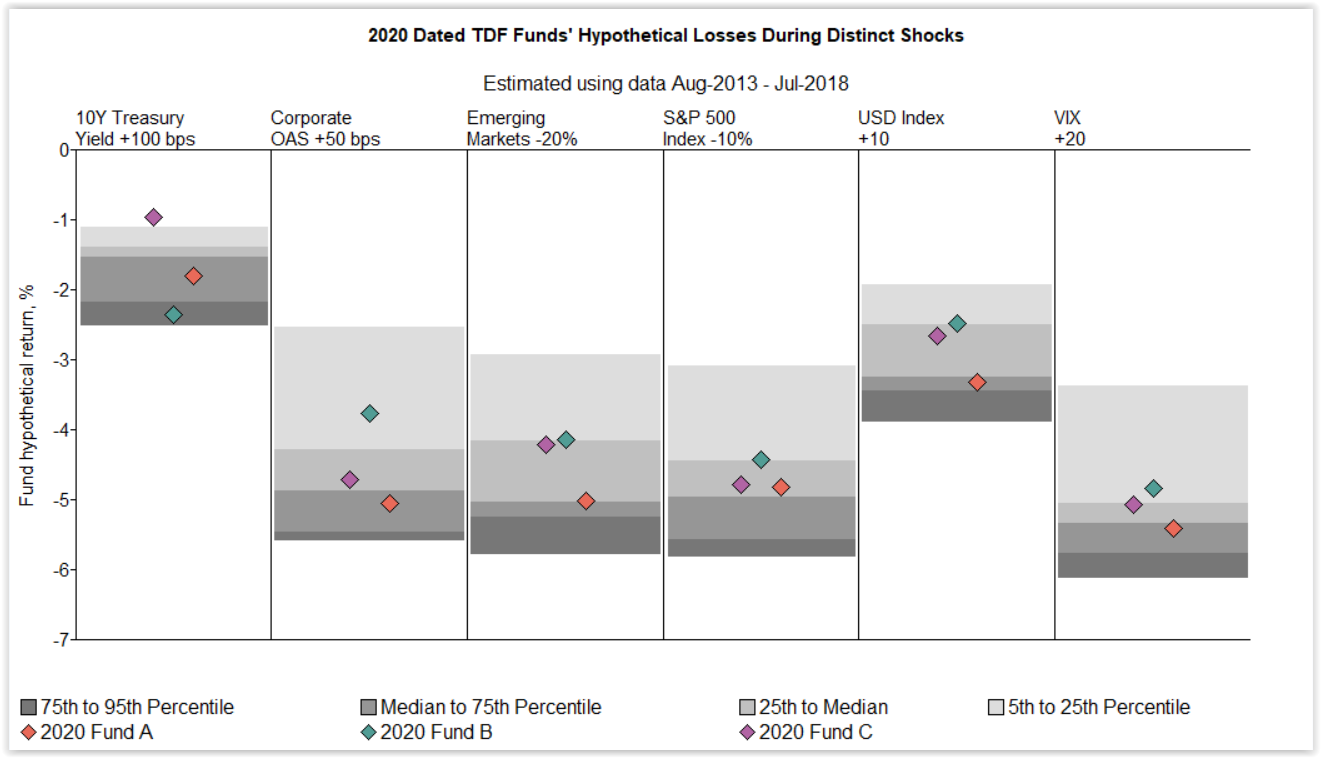

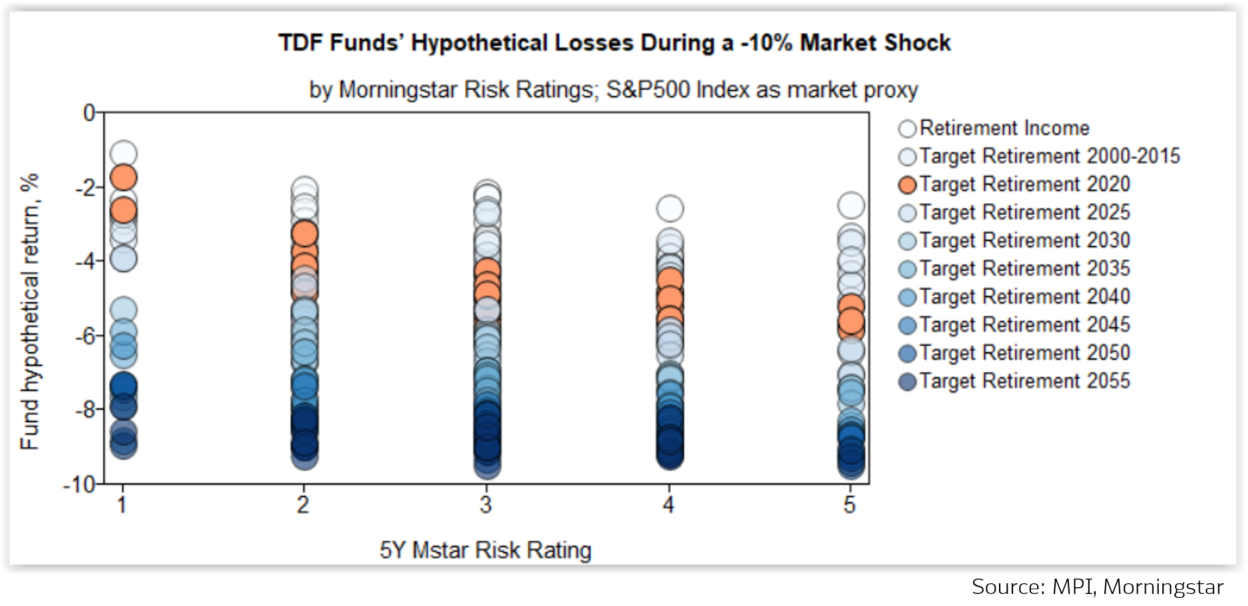

In this post, our research team demonstrates how scenario analysis can highlight different risk sensitivities among same-vintage TDFs that could go undetected by traditional risk measures.

In this post, our research team shows how returns-based scenario analysis can be used to enhance traditional portfolio risk analysis by helping to assess potential fund performance through extreme market events.

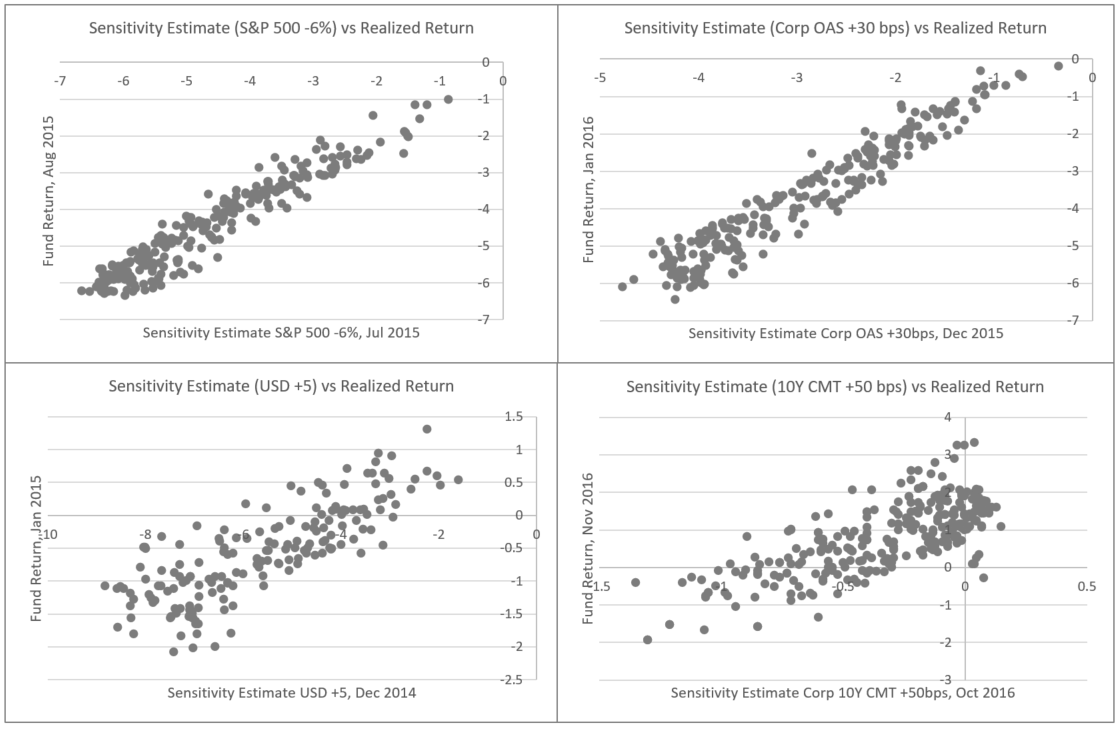

In this post, our research team demonstrates a clever way to backtest forward-looking scenarios commonly used in portfolio risk analysis.

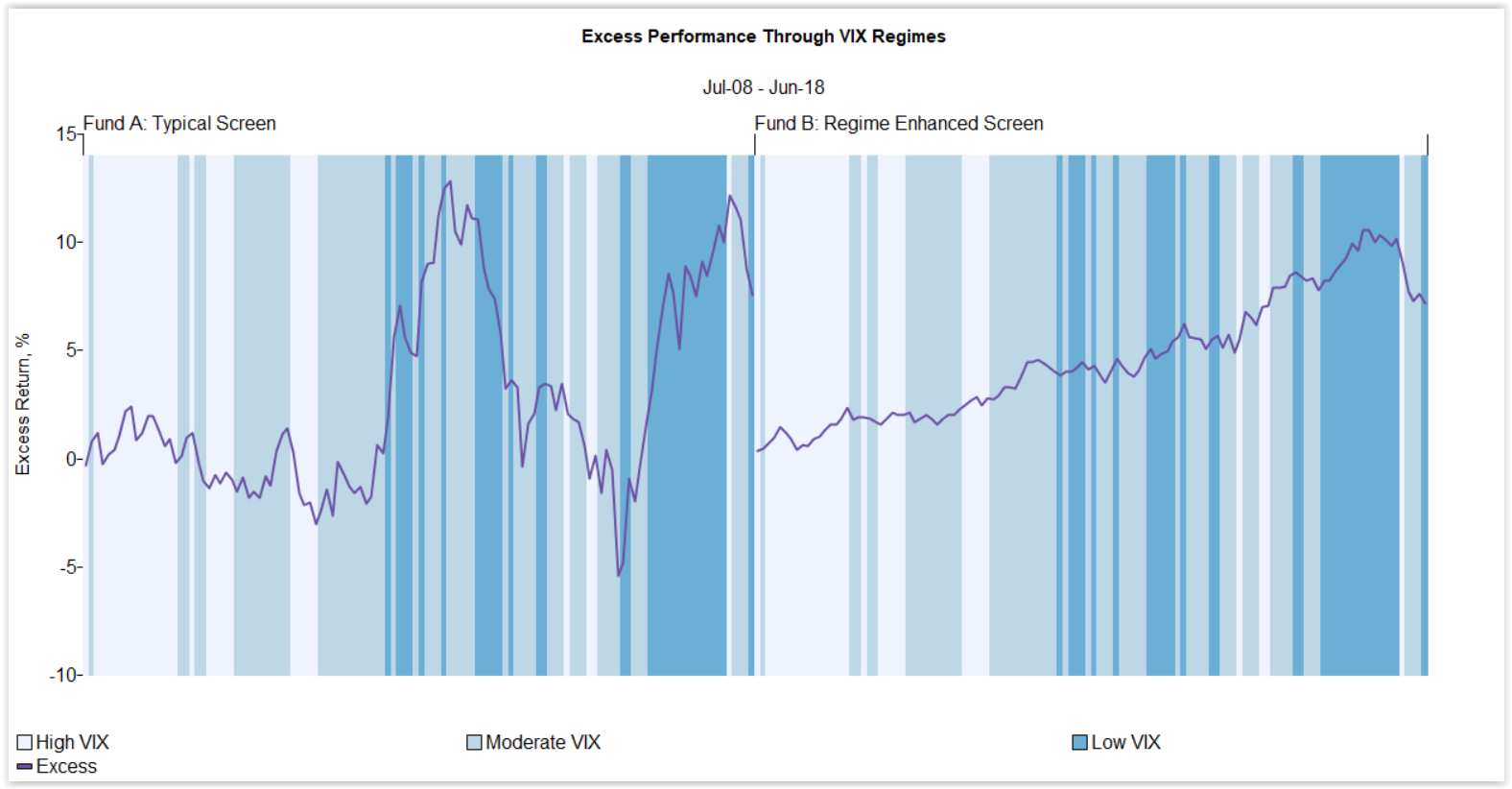

In this post, our research team uses regime-based investment risk analytics to present an approach to assessing the size and significance of investor blind spots during a typical manager screening process.

New proxy-handling features also allow users to extend analysis for shorter-lived investment products and portfolios