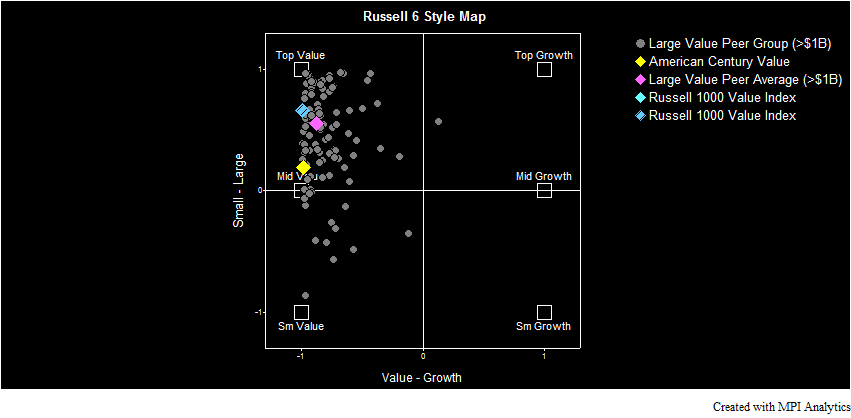

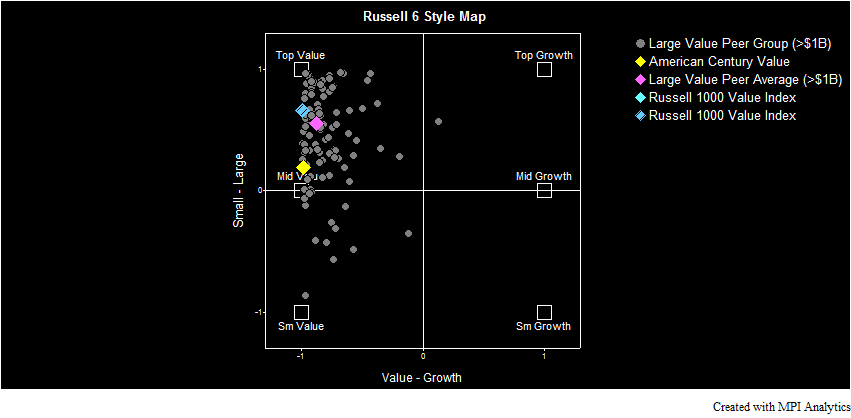

Does alleged index hugger American Century Value really belong on the naughty list?

Does alleged index hugger American Century Value really belong on the naughty list?

Using Norwegian pension as an example we provide a quick and easy path for US pensions to become more transparent and regain trust of their beneficiaries as well as general public

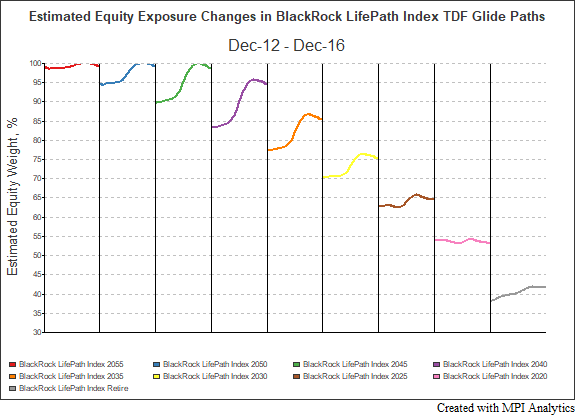

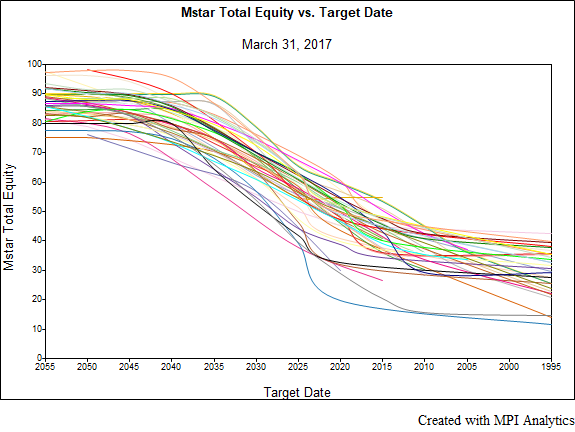

Morningstar’s 2017 Target Date Landscape Report indicates that approximately one quarter of TDF series shifted the target equity allocation of at least one vintage by 15% or more over the last 5 years and nearly half by at least 5%.

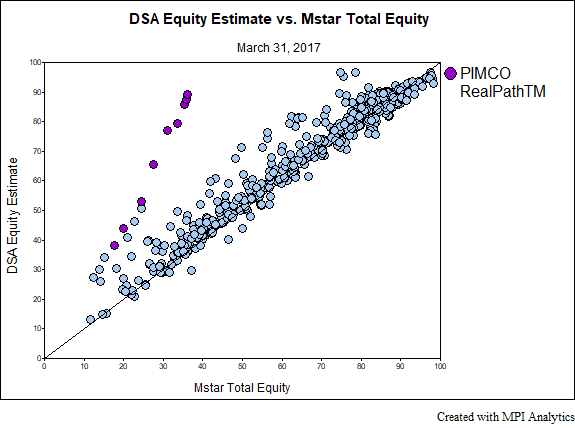

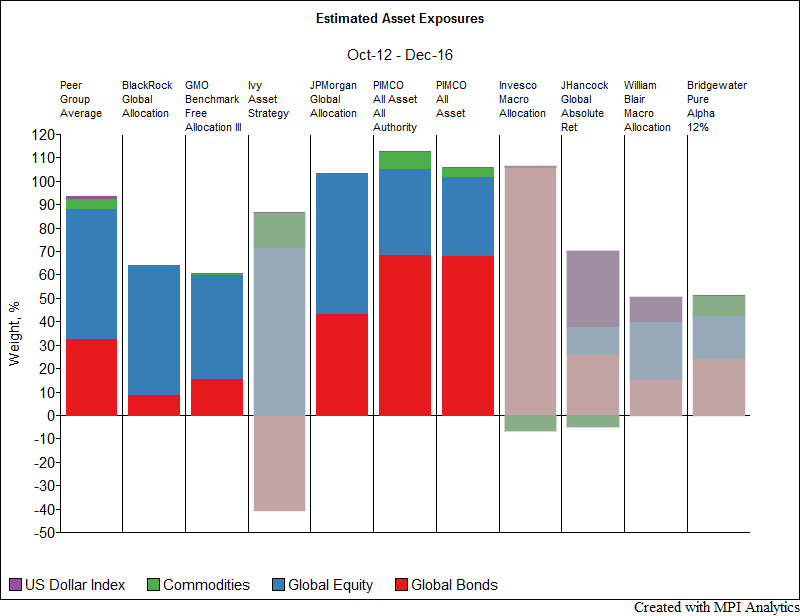

Four of the other five fund families with holdings vs. returns-based discrepancies are of a similar nature in that they have investments in derivatives, leveraged funds or absolute return funds, which affect the holdings tally. In each of these cases, DSA provides a much closer estimate to the intended systematic exposure.

We demonstrate the advantages of using returns-based analysis in determining the effective glide-paths of Target-Date Funds vs. the stated ones

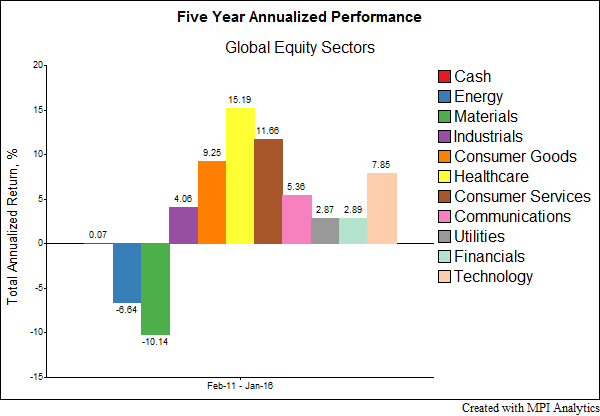

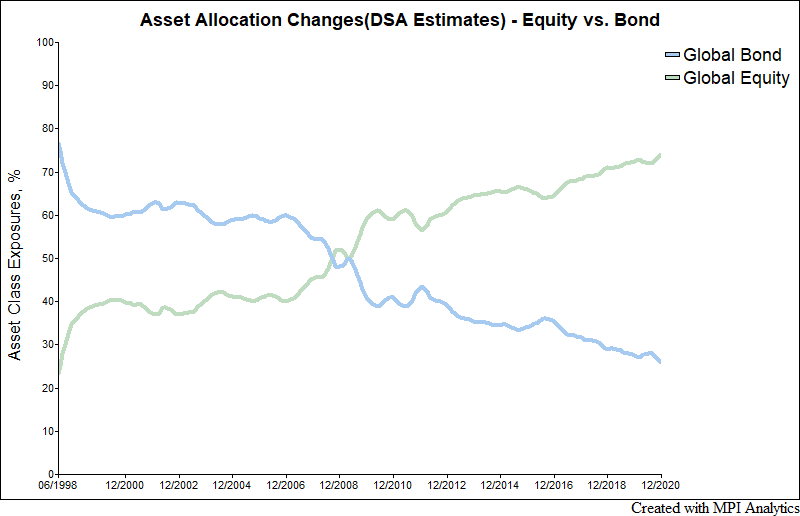

Global Tactical Asset Allocation (GTAA) funds, which seek to take advantage of changing market conditions while maintaining a globally diversified portfolio, have suffered recent underperformance. MPI was asked by Institutional Investor to look at some of the funds that have received the most interest from investors.

Using Standard Life Global Absolute Return Fund (SLI GARS) weekly performance data, we show how sophisticated factor analysis can provide valuable insights into this fund’s complex global “go anywhere” investment strategy.