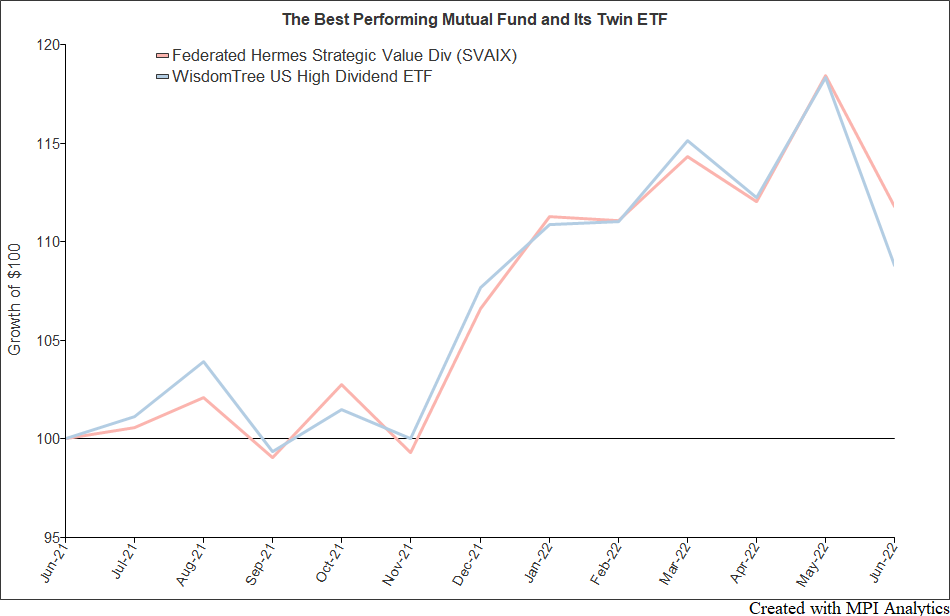

A WSJ article features a fund which outperformed all of the actively managed US stock mutual funds by a large margin. We found its twin ETF from WisdomTree that was spared the accolades. And we use advanced quant techniques to dissect the strategy and its winning bets.