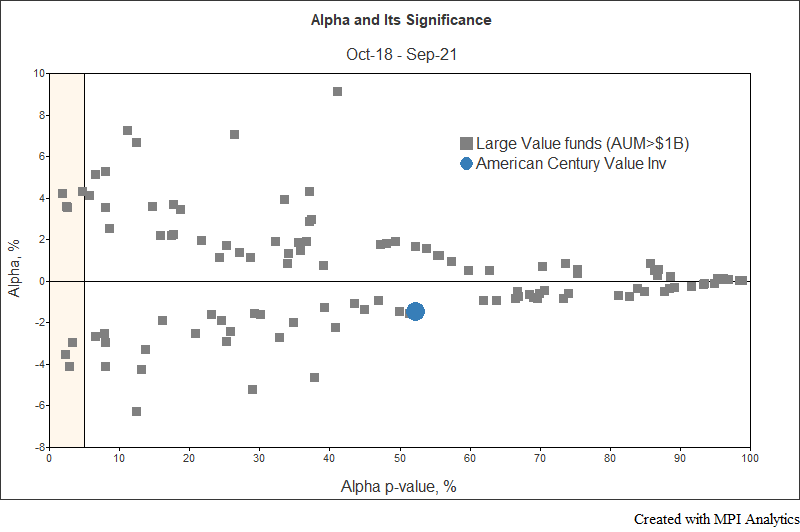

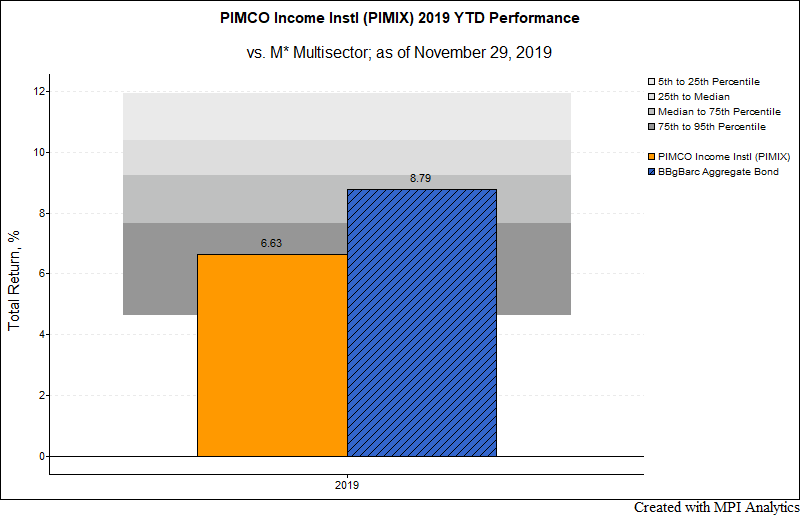

A fund’s alpha is at the core of a class-action lawsuit.

A fund’s alpha is at the core of a class-action lawsuit.

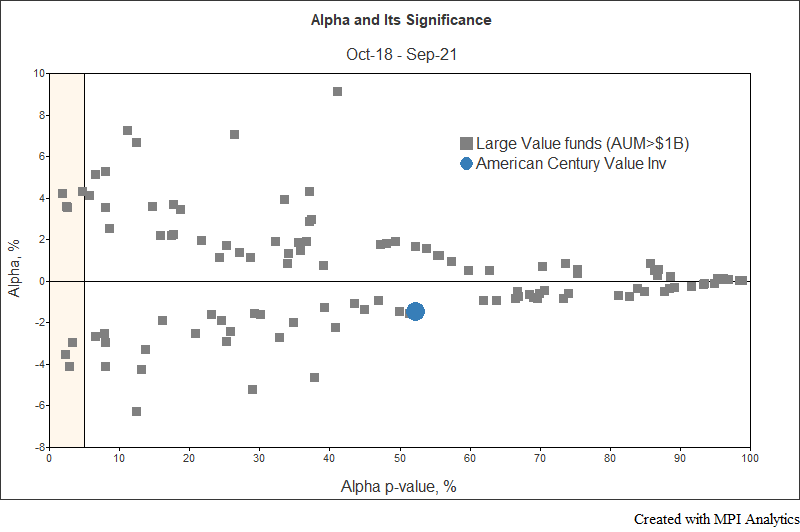

Does alleged index hugger American Century Value really belong on the naughty list?

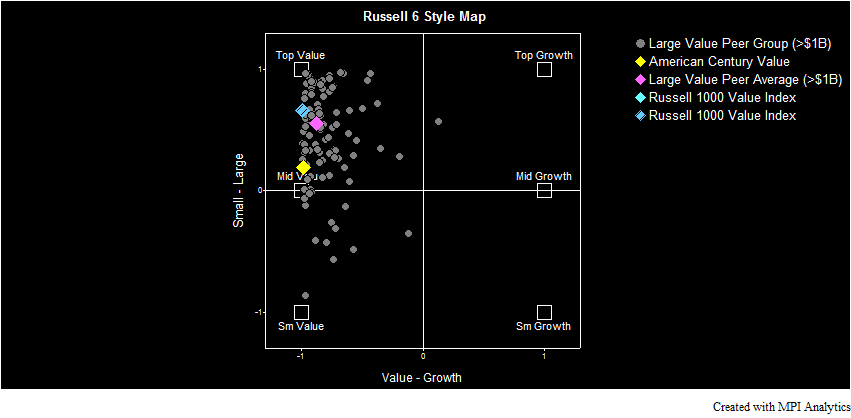

Since its launch in 2007, PIMCO Income Fund has become one of the top-performing US bond funds. However, in 2019 the fund has underperformed both the benchmark and most of its peers. Using this fund as an example, we will demonstrate how advanced returns-based analysis can be used to analyze complex fixed income products without delving into volumes of complex holdings.

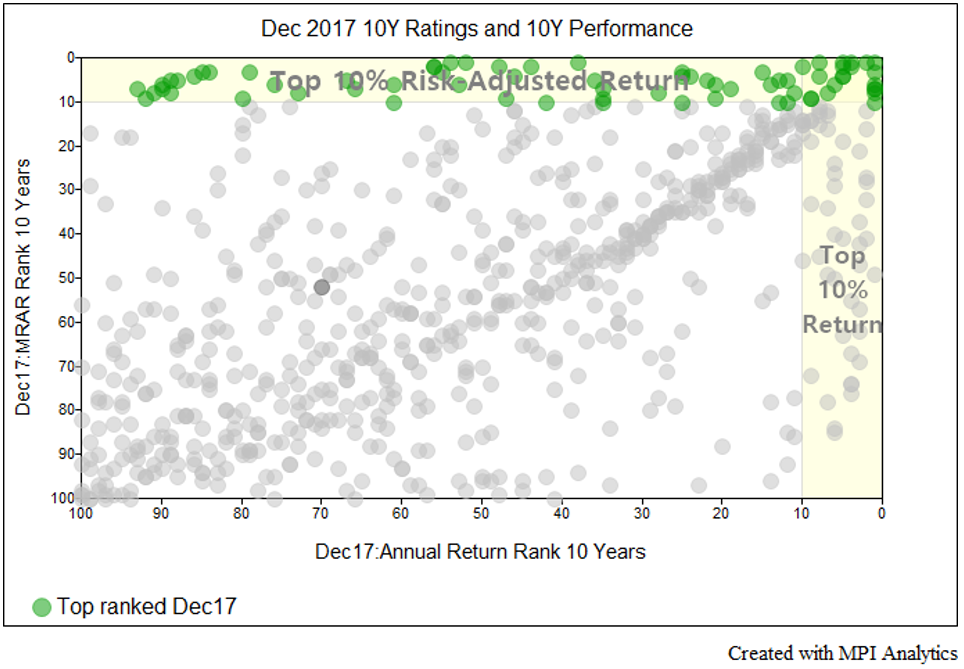

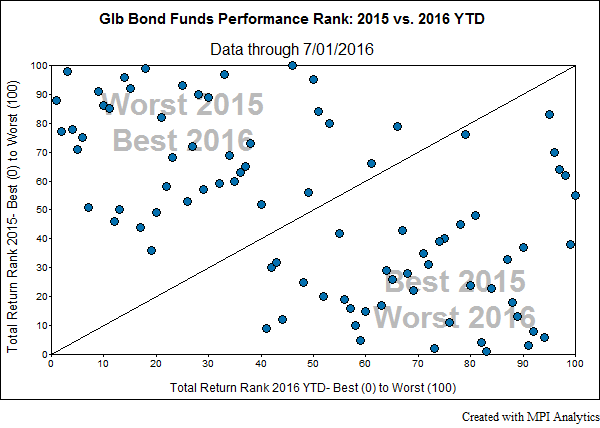

In this post, our research team examines why investors should proceed with caution when selecting top-ranked funds.

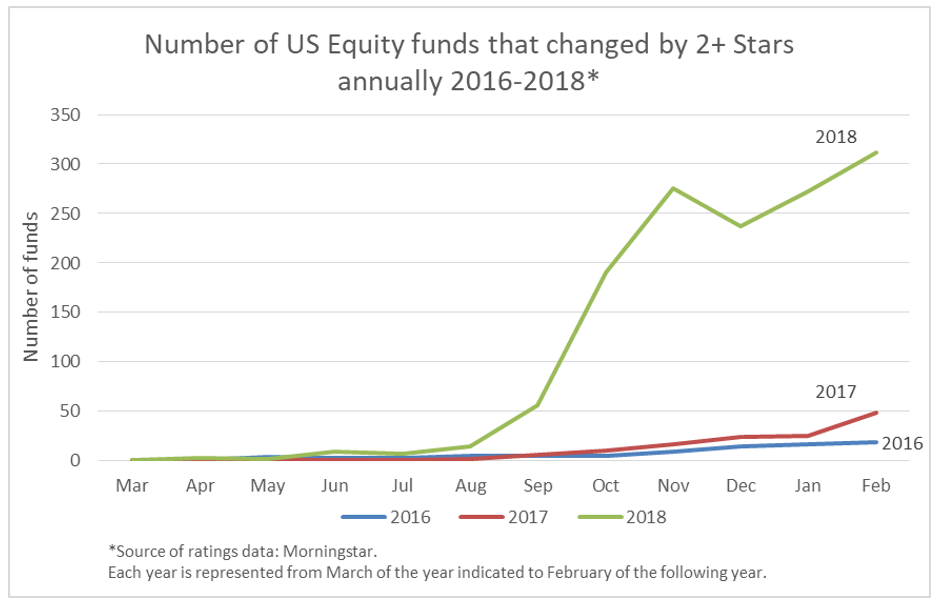

While the health of the bull market, the raging fee wars and the ongoing active vs. passive debate continue to capture the money management industry’s attention, something fascinating has quietly taken place on fund analysts’ radars.

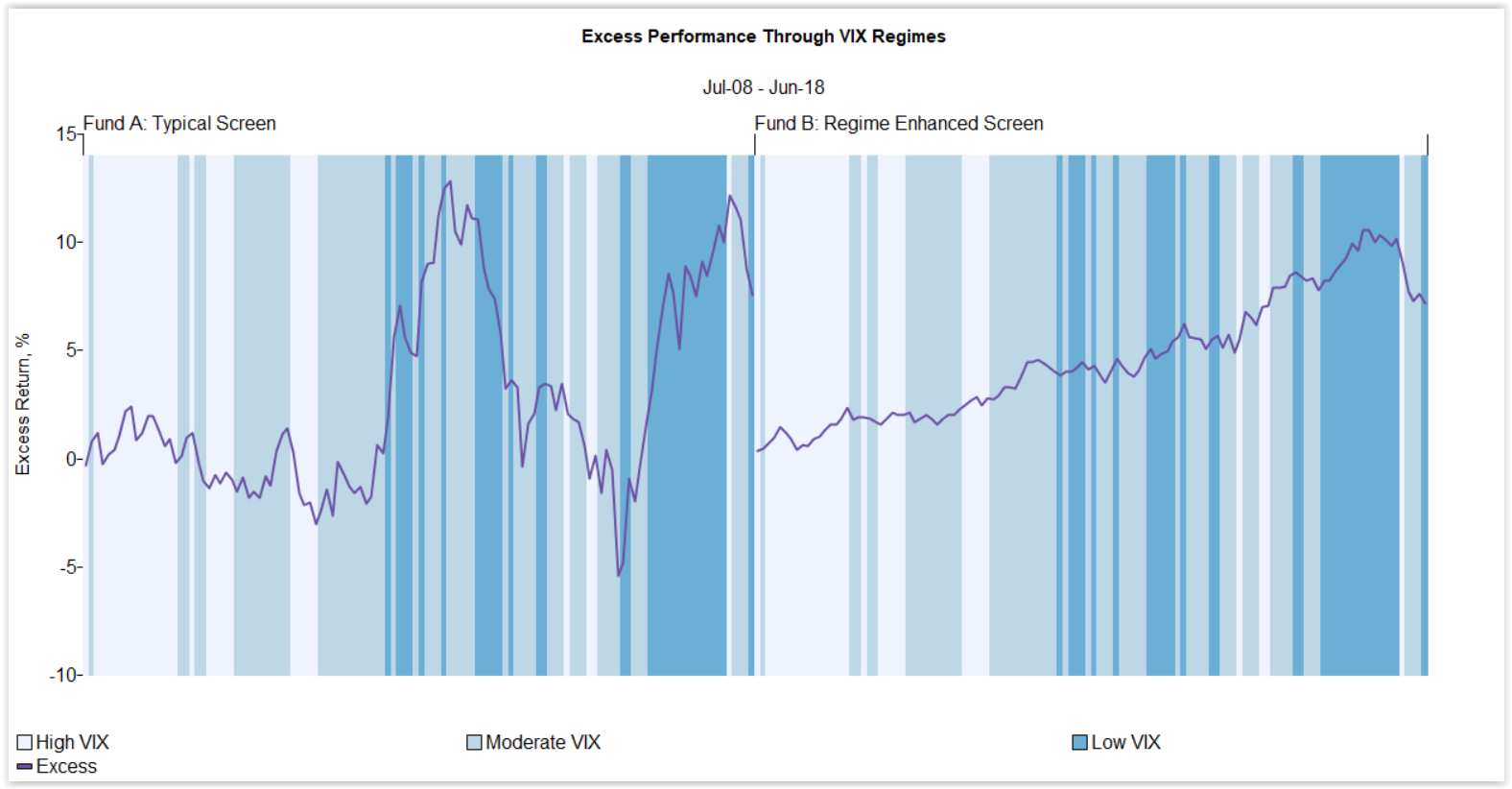

In this post, our research team uses regime-based investment risk analytics to present an approach to assessing the size and significance of investor blind spots during a typical manager screening process.

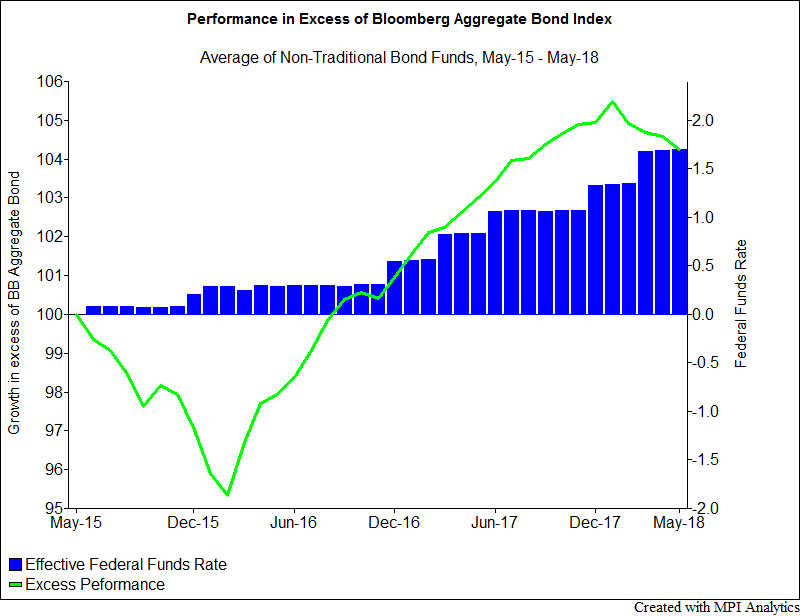

After years of underperformance following the financial crisis, the non-traditional bond fund segment is beginning to shine, outperforming the broader market index in the face of rising rates.

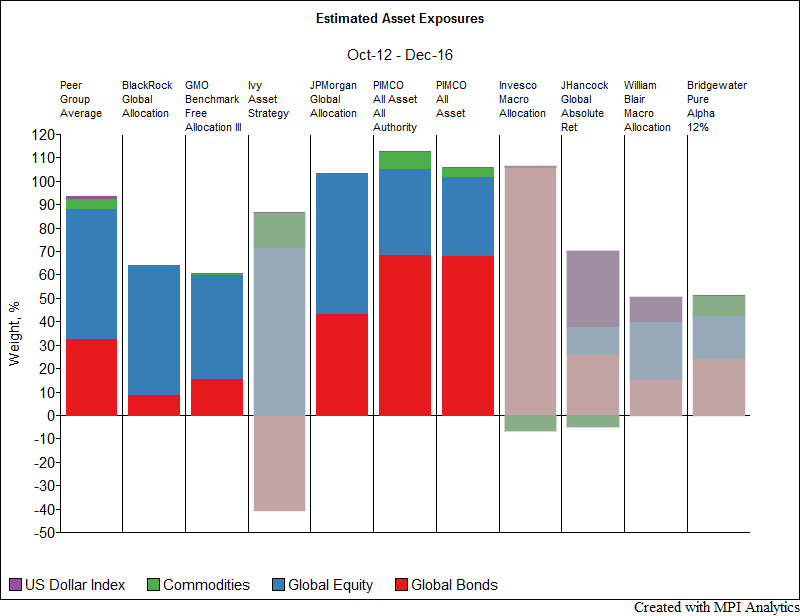

Global Tactical Asset Allocation (GTAA) funds, which seek to take advantage of changing market conditions while maintaining a globally diversified portfolio, have suffered recent underperformance. MPI was asked by Institutional Investor to look at some of the funds that have received the most interest from investors.

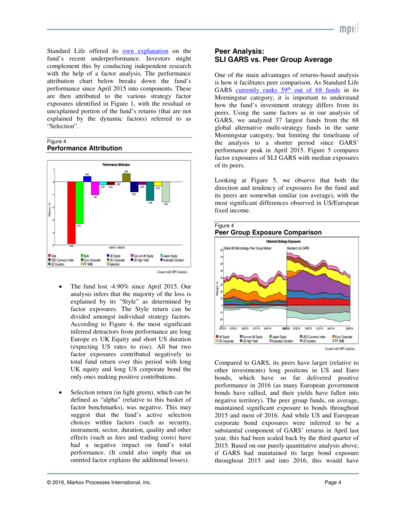

Using Standard Life Global Absolute Return Fund (SLI GARS) weekly performance data, we show how sophisticated factor analysis can provide valuable insights into this fund’s complex global “go anywhere” investment strategy.

In the winter of 2015, an almost unheard of situation happened. A mutual fund, normally required to guarantee daily liquidity, blocked its clients from withdrawing money. The Third Ave Focused Credit Fund (TFCIX), citing losses and a lack of liquidity in the high yield bond market, put some of its assets into a trust to be sold over time.