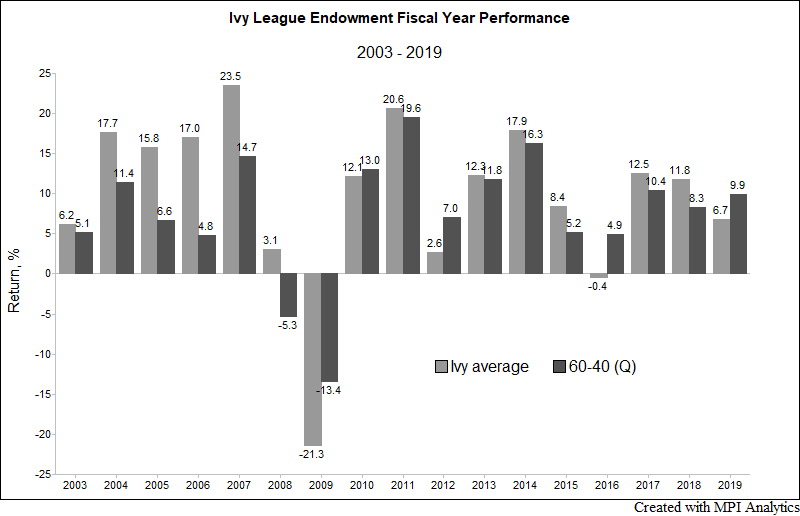

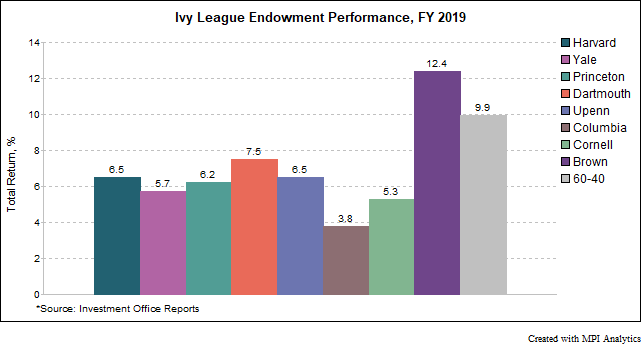

Fiscal year 2019 was a curious year for the Ivy League endowments. In a year with strong returns in key private market investment classes, the average Ivy underperformed a traditional domestic balanced 60-40 portfolio in FY 2019. Ivies also experienced a wider dispersion of returns and saw a shift in the historical positioning of performance leaders and laggards.