Most endowments have been propped up by a similar concentration in private assets. The ones that suffered the worst, however, couldn’t have been more different in their approach.

Most endowments have been propped up by a similar concentration in private assets. The ones that suffered the worst, however, couldn’t have been more different in their approach.

MPI is continuing its long tradition of bringing you special insights into the true drivers of endowment performance and risk. Stay tuned for the launch of our new Endowments research hub, and exciting daily updates throughout the FY2022 reporting season.

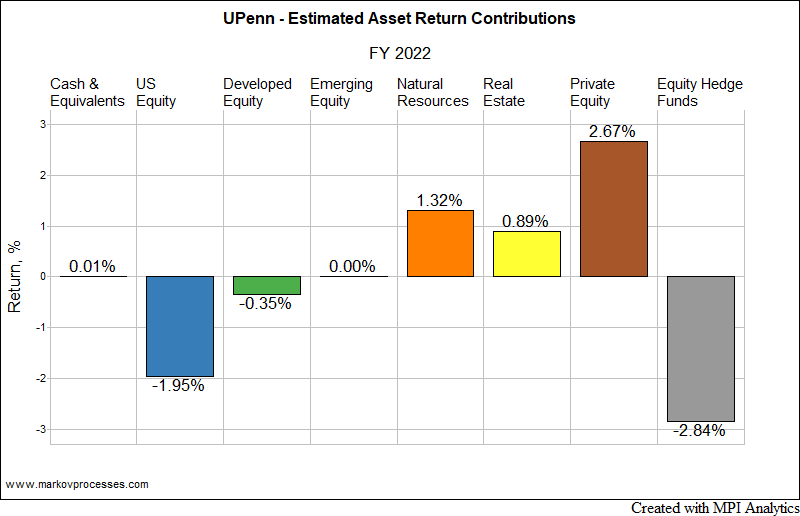

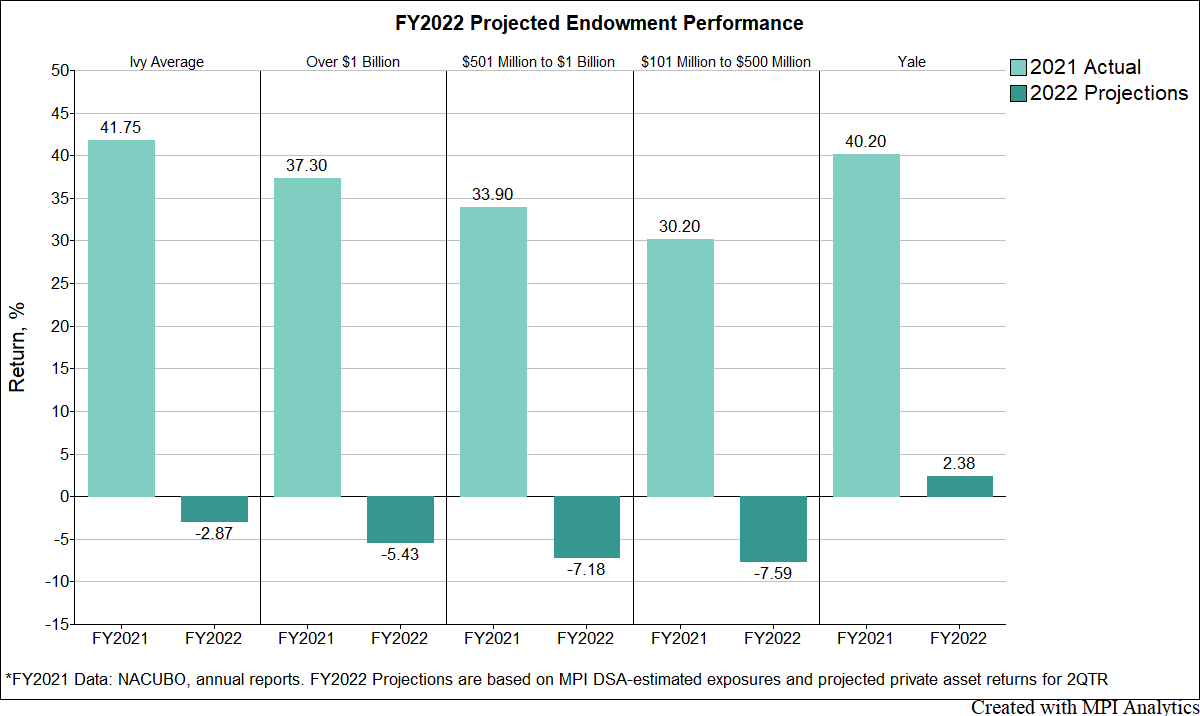

We embarked on a project to estimate 2022 FY performance for Ivies and major US university endowments… weeks before official reports become available.

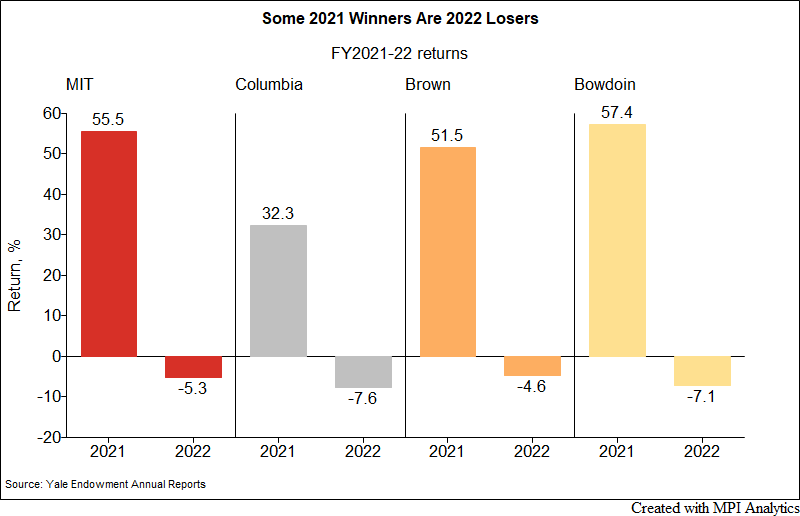

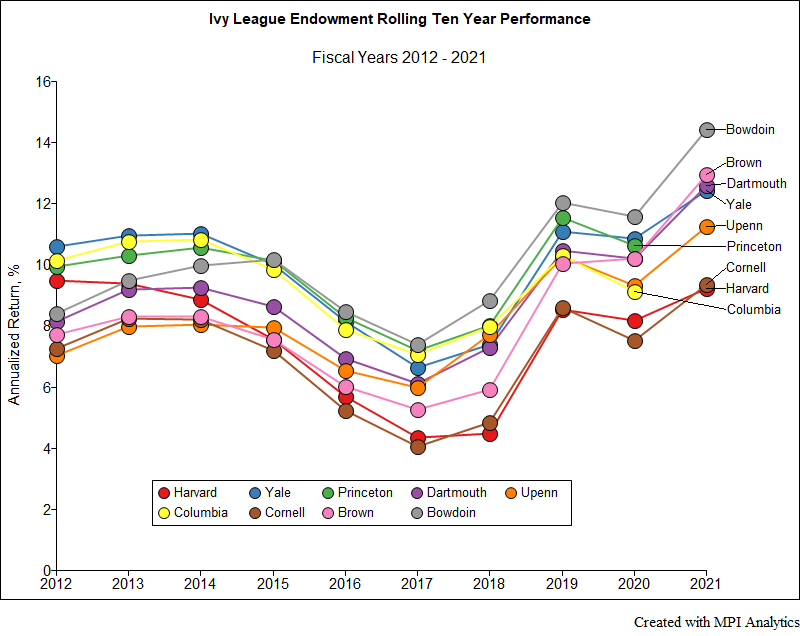

Bowdoin College Endowment has been outperforming all Ivies on a 10-year basis since 2015 with its latest FY2021 result bringing it to 14.4%, an almost impossible number to beat.

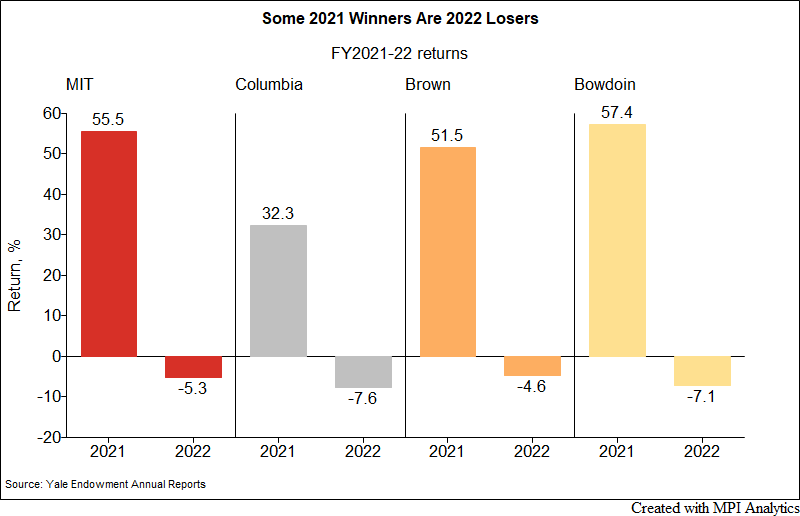

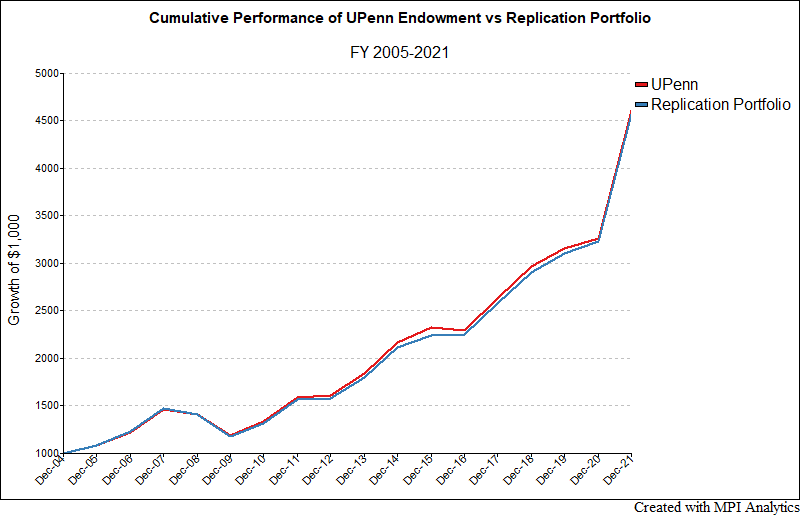

UPenn’s $20.5 Billion endowment posted a return of 41.1% for FY 2021, driven by strong returns in private equity and venture capital.

AlternativesWatch’s Susan Baretto explores how MPI’s patented analysis technique — Dynamic Style Analysis, was used to dissect Brown University’s endowment annual returns, providing a plausible explanation of the outlier’s spectacular FY20 results.

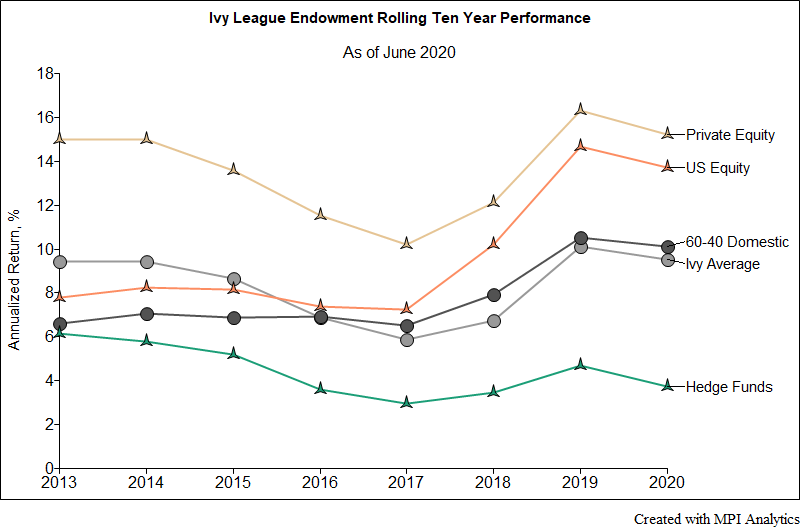

ThinkAdvisor features MPI’s analysis on the FY20 Ivy Endowment results, with Brown standing out as the exception; beating a 60–40 portfolio of U.S. domestic stocks and bonds.

We take a quick look at Ivy schools’ endowments’ performance results both for the 2020 fiscal year and also long-term for 10-year periods.

“Last year was a great one for private equity and venture capital, but Ivy League endowments, with their huge allocations to alternative investments, didn’t all benefit, according to MPI.,” writes Julie Segal about MPI’s research in her article in Institutional Investor.

Ivy endowment report offers cautionary tale for investors and allocators to private markets