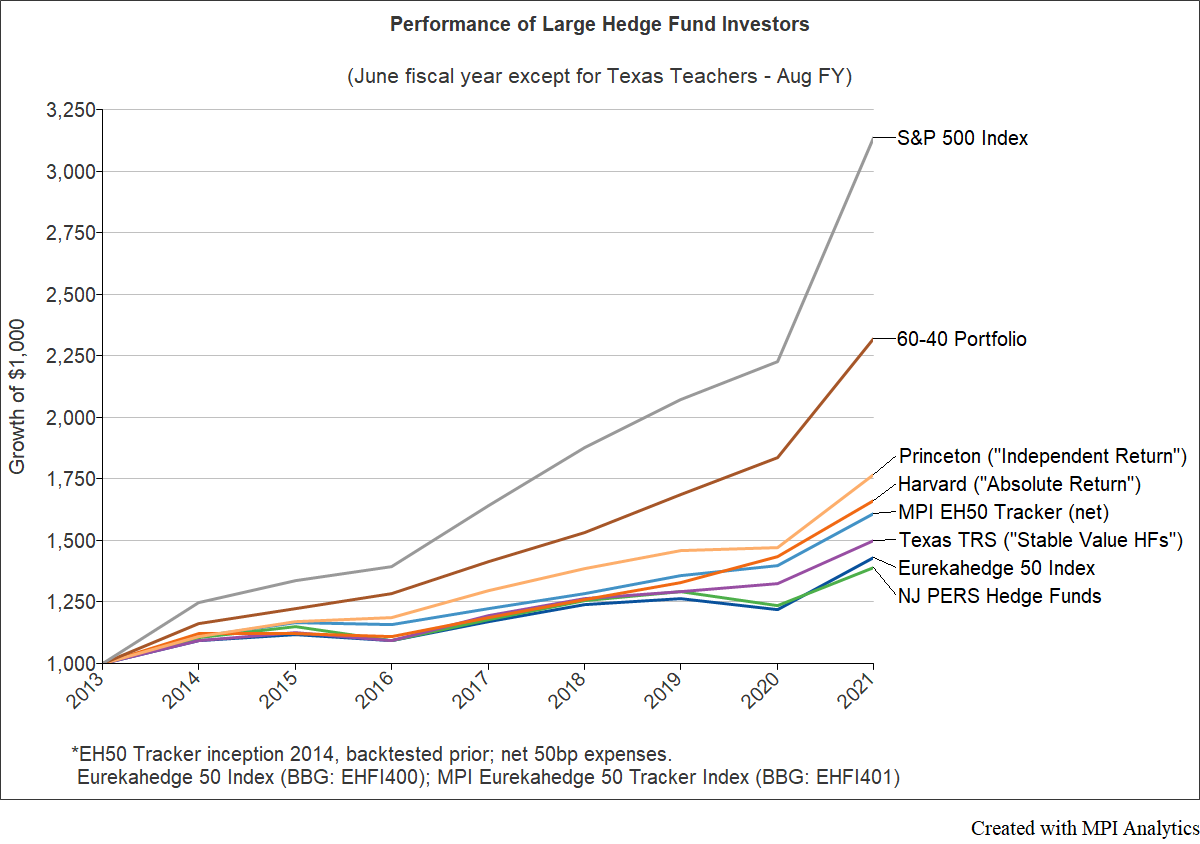

MPI today released eight-year performance data for its MPI Eurekahedge 50 Tracker Index that indicate its basket of liquid, retail exchange-traded funds can deliver the performance of a diversified portfolio of institutional-quality hedge funds.

ETF strategies

Eight years ago, we partnered with Eurekahedge to develop a unique hedge fund benchmark. We review live performance of the index and its liquid tracker – MPI Eurekahedge 50 Tracker Index.

MPI Adds Volatility Versions to Hedge Fund Benchmarks

“Target volatility versions of the MPI Eurekahedge 50 Tracker Index are now available with 6% or 8% volatility, while the MPI Best 20 Tracker Index, which tracks the MPI Barclay Elite Systematic Traders Index, comes in 8% and 10% volatility versions. “You can scale up the volatility and scale up the risk level of the proxy index to get an ‘apples-to-apples’ comparison,” said Rohtas Handa, head of institutional solutions at MPI.” Read the full article here.

New Benchmarks Deliver Greater Precision for Manager Selection and Daily Monitoring of Portfolio Performance and Risk

New Offering Leverages MPI’s Expertise, Patented Model to Create Better Benchmarks for Elite Hedge Fund Performance

MPI Ties up with Eurekahedge & BarclayHedge

“Selection/non-reporting bias, survivorship bias, and backfill or instant history bias can all serve to artificially inflate index returns, which are often higher for non-investable than for investable hedge fund indices,” explains Hamlin Lovell, in his feature article on the launch of MPI’s Hedge Fund Indices business. “According to MPI, these biases can be overcome by building a representative index comprised of a selective group of the largest funds.” Read the article here.

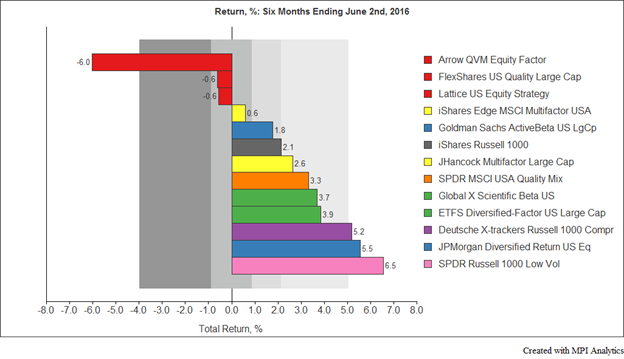

The questions fueling “smart beta” debates carry on, but that hasn’t stopped a number of providers from launching a “smarter” product – and from picking up assets as a result. In this first post of a series, MPI will begin to explore multi-factor smart beta, an up-and-coming take on the strategic beta concept.

MPI Partners with Eurekahedge for New Hedge Fund Index, Eurekahedge 50

MPI partners with Eurekahedge to create and maintain the Eurekahedge 50 Index, a new benchmark index tracking the top 50 hedge funds. The Eurekahedge 50 Index was created to meet the demands of institutional hedge fund investors seeking a more selective benchmark reflective of diversified institutional quality hedge fund portfolios. The Eurekahedge 50 Index tracks the returns of the top hedge funds based on longevity, assets under management and quality of risk-adjusted returns, taking into account stability and consistency. See the press release here.