Here’s how Yale’s endowment left its Ivy League rivals behind

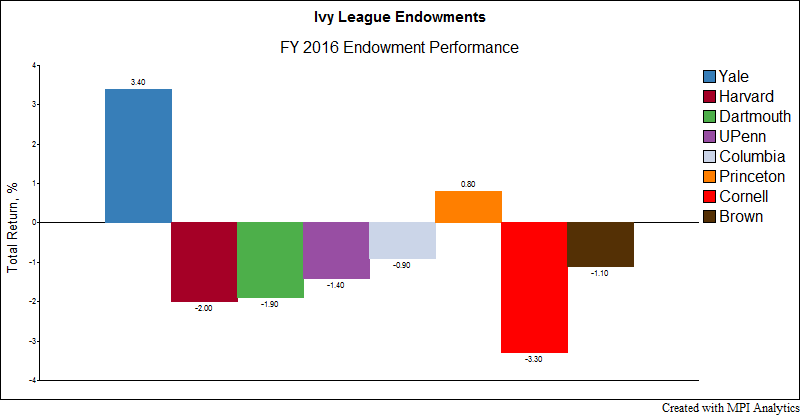

MarketWatch reports that MPI said asset allocation remained the most important factor in endowment performance, as returns at Ivy League endowments dropped off over the past year.

MarketWatch reports that MPI said asset allocation remained the most important factor in endowment performance, as returns at Ivy League endowments dropped off over the past year.

The short answer, following a year in which the Yale CIO and the endowment he leads avoided carnage in commodities and emerging markets, is no. Here’s why.

There’s book smart and there’s money smart, and sometimes those two things don’t coincide. That could be the takeaway from the latest data from risk analytics firm MPI (Markov Processes International, which reviewed how Ivy League endowments are performing this year. The answer is not great for many of America’s top schools. See more about these insights on Barron’s.

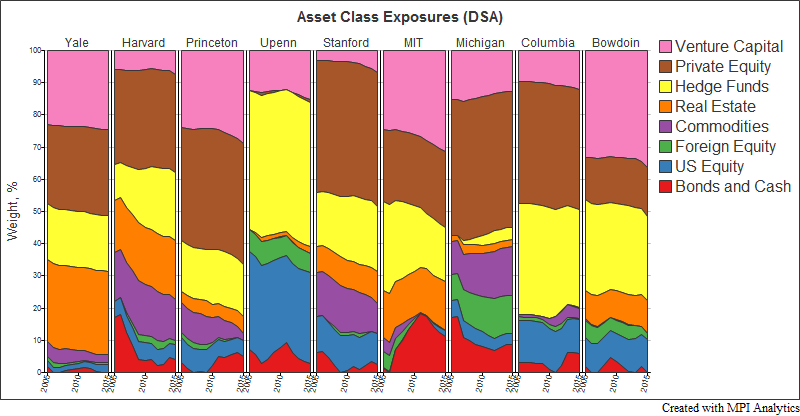

An 1873 meeting that brought Harvard, Yale and Princeton together to codify the rules of American football also debuted a sports conference later known as the “Ivy League — eight elite institutions whose heritage, dating from pre-Revolutionary times, became formative influences shaping American character and culture. These schools also pioneered endowment investment management, thus helping to secure the nation’s educational legacy for posterity.

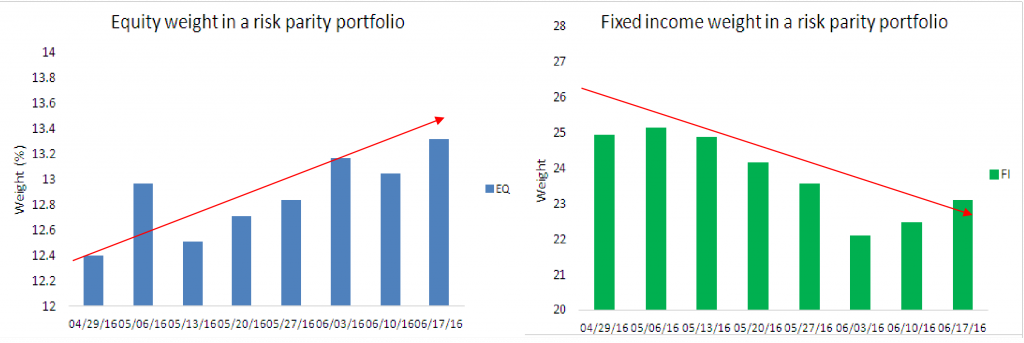

Risk parity strategies hold the promise of smooth sailing through periods of market turbulence, offering consistent performance via risk diversification. However, during Brexit the losses they experienced were very high by historical standards as they came very close to exceeding, or exceeded, the 95% worst outcome as estimated by the historical VaR.

Using MPI’s Dynamic Style Analysis and public annual return disclosures we attempt to provide transparency on allocation decisions and performance results of some of the largest and most successful investors in the world.