Why Low-Cost, No-Frills Portfolios Are Beating the Geniuses at Harvard and Yale

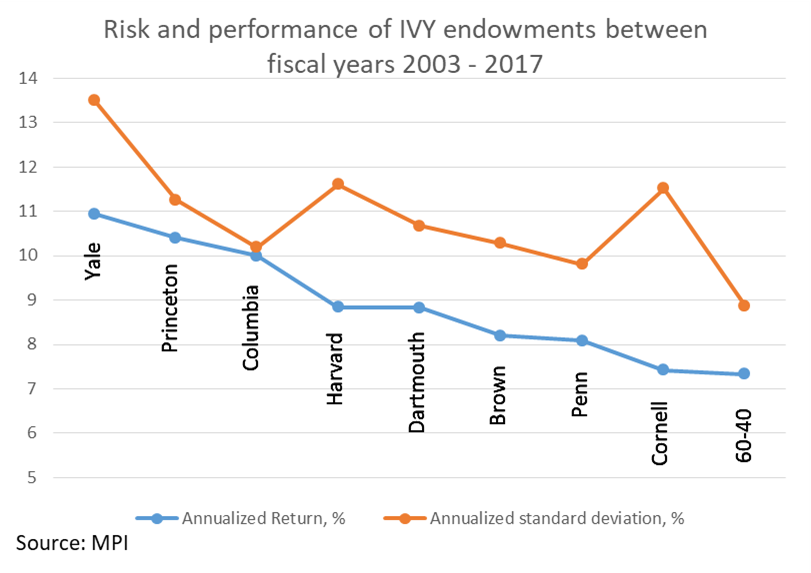

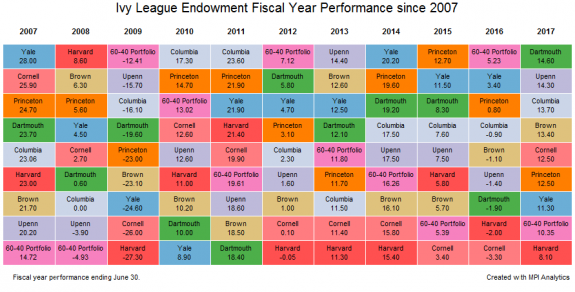

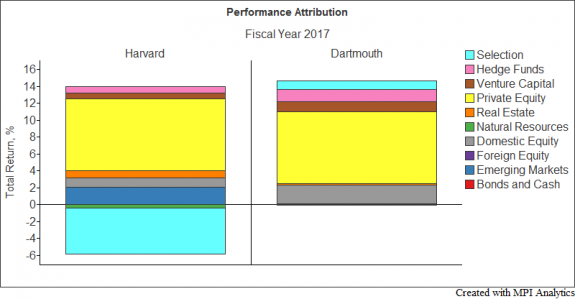

“Even Harvard and Yale, which have expert teams of academics and Wall Street managers overseeing their multibillion endowments, have been unable to do much better over time than a simple blend of index funds,” says Ian McGugan of The Globe and Mail. “In fact, an utterly standard index fund blend of 60% stocks and 40% bonds would have outpaced the returns most Ivy League endowments have achieved over the past decade…according to a recent report by Markov Processes International, an investment research firm (subscription required to read article). Read the MPI report here.