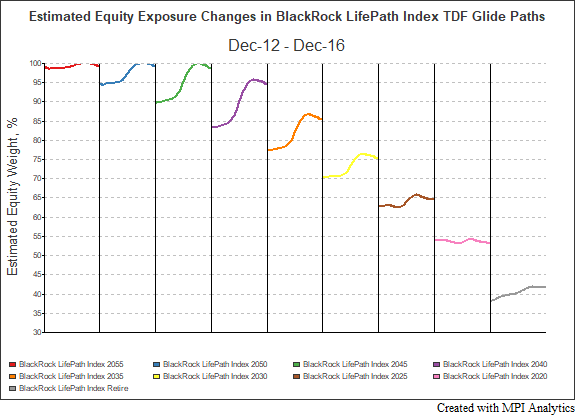

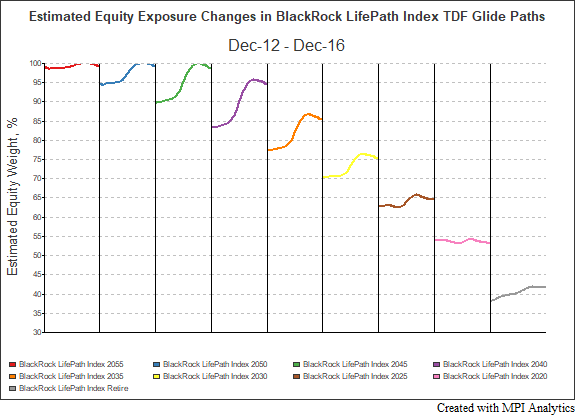

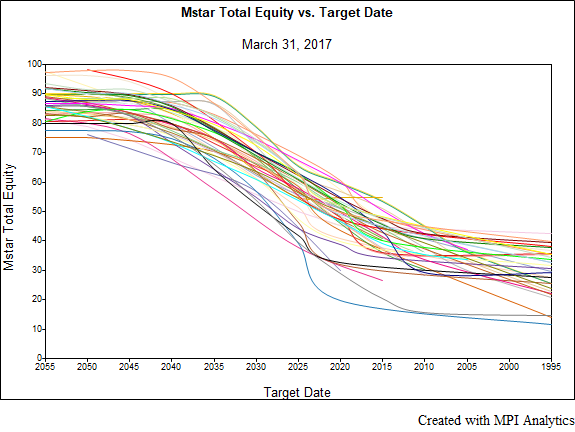

Morningstar’s 2017 Target Date Landscape Report indicates that approximately one quarter of TDF series shifted the target equity allocation of at least one vintage by 15% or more over the last 5 years and nearly half by at least 5%.

Morningstar’s 2017 Target Date Landscape Report indicates that approximately one quarter of TDF series shifted the target equity allocation of at least one vintage by 15% or more over the last 5 years and nearly half by at least 5%.

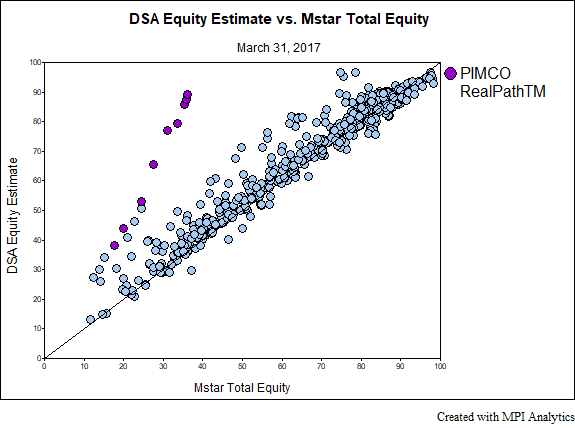

Four of the other five fund families with holdings vs. returns-based discrepancies are of a similar nature in that they have investments in derivatives, leveraged funds or absolute return funds, which affect the holdings tally. In each of these cases, DSA provides a much closer estimate to the intended systematic exposure.

We demonstrate the advantages of using returns-based analysis in determining the effective glide-paths of Target-Date Funds vs. the stated ones

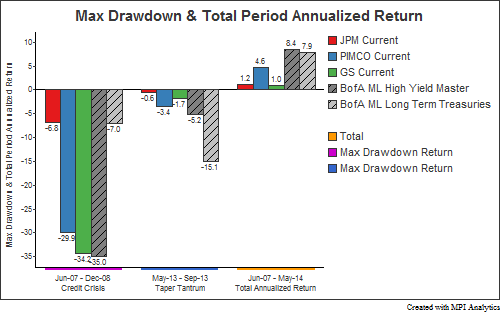

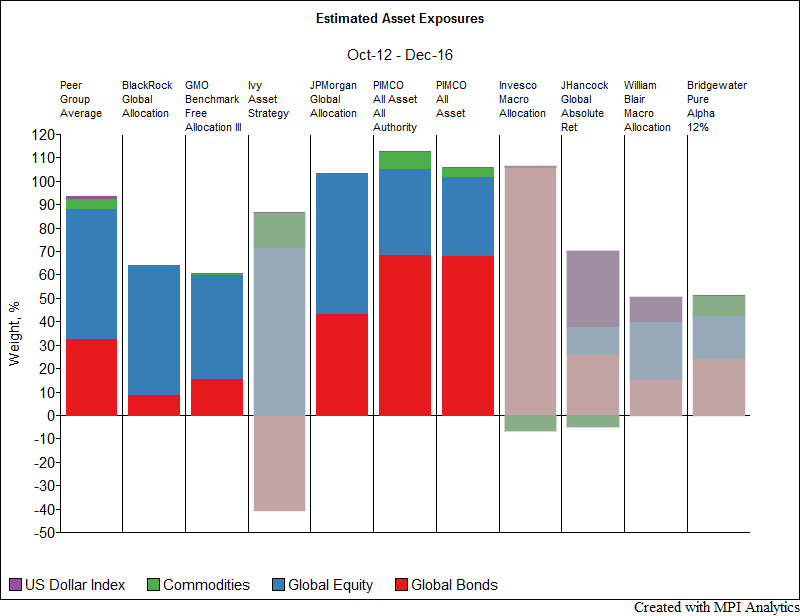

Global Tactical Asset Allocation (GTAA) funds, which seek to take advantage of changing market conditions while maintaining a globally diversified portfolio, have suffered recent underperformance. MPI was asked by Institutional Investor to look at some of the funds that have received the most interest from investors.

Using Standard Life Global Absolute Return Fund (SLI GARS) weekly performance data, we show how sophisticated factor analysis can provide valuable insights into this fund’s complex global “go anywhere” investment strategy.

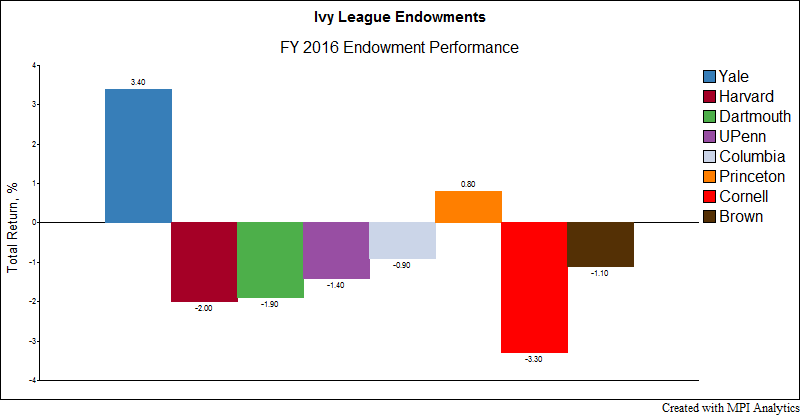

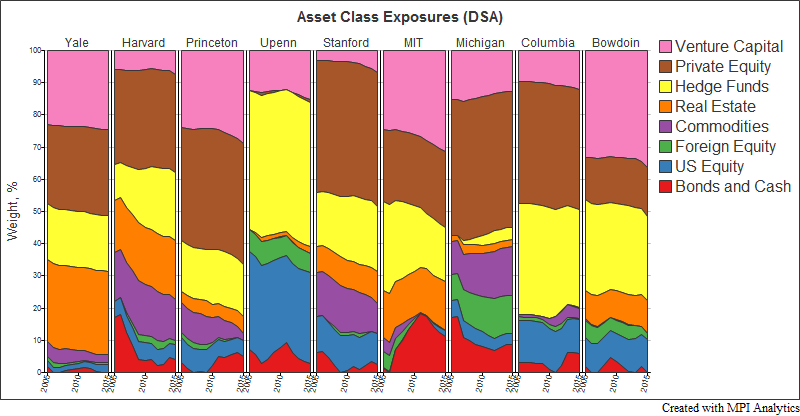

An 1873 meeting that brought Harvard, Yale and Princeton together to codify the rules of American football also debuted a sports conference later known as the “Ivy League — eight elite institutions whose heritage, dating from pre-Revolutionary times, became formative influences shaping American character and culture. These schools also pioneered endowment investment management, thus helping to secure the nation’s educational legacy for posterity.

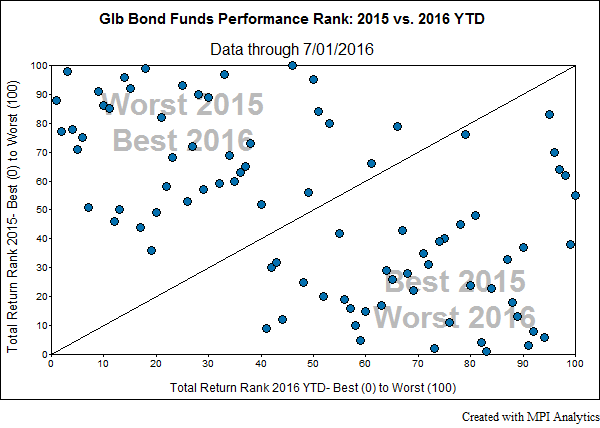

In the winter of 2015, an almost unheard of situation happened. A mutual fund, normally required to guarantee daily liquidity, blocked its clients from withdrawing money. The Third Ave Focused Credit Fund (TFCIX), citing losses and a lack of liquidity in the high yield bond market, put some of its assets into a trust to be sold over time.

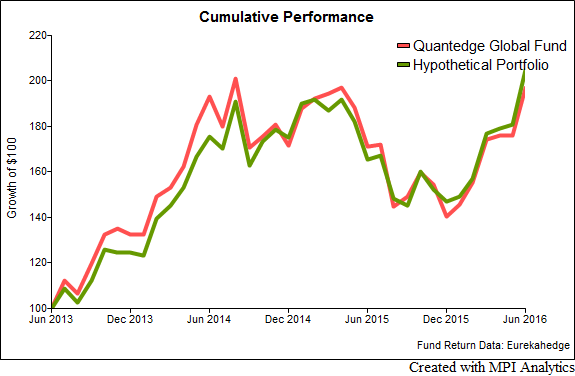

A July 20th WSJ article featured Quantedge Capital, a quantitative global macro hedge fund manager that gained 40% after fees year-to-date through June. We provide a quantitative insight into potential sources of such performance.

Using MPI’s Dynamic Style Analysis and public annual return disclosures we attempt to provide transparency on allocation decisions and performance results of some of the largest and most successful investors in the world.