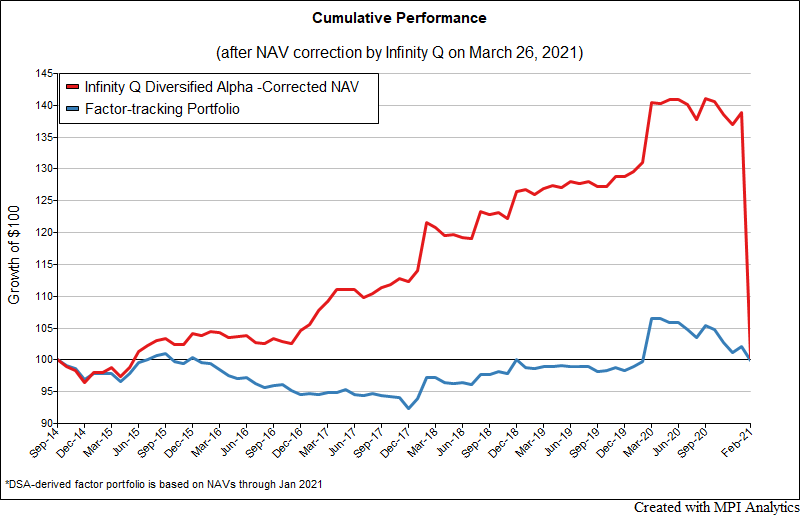

The suspension of redemptions and planned liquidation of the Infinity Q Diversified Alpha fund (IQDNX, IQDAX) – a $1.8 billion hedge fund-like multi-strategy liquid alternatives mutual fund that was started by investment staff from the family office of a private equity titan – has sent shockwaves through the fund management industry. Using MPI’s quantitative surveillance framework we discover a slew of red flags that could have alerted the fund’s investors.