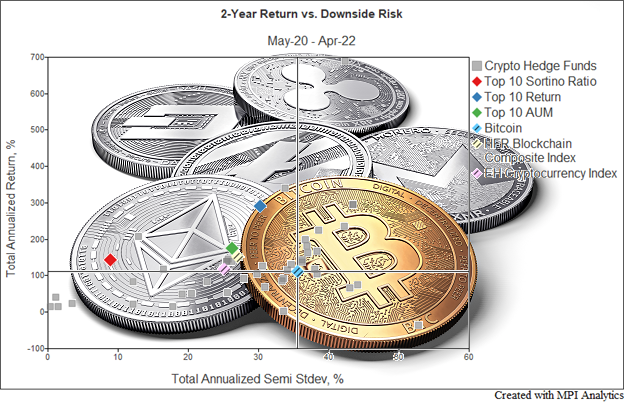

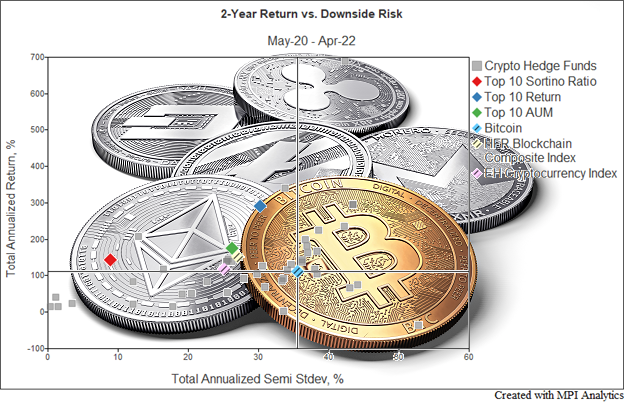

We look at the universe of active crypto hedge funds and observe that by and large they delivered on the promise… at least the ones that survived so far.

We look at the universe of active crypto hedge funds and observe that by and large they delivered on the promise… at least the ones that survived so far.

Investors – and the Feds – need to focus less on specific stories like MicroStrategy’s Bitcoin exposure, and more on how big the systemic risk picture may be for all of us.

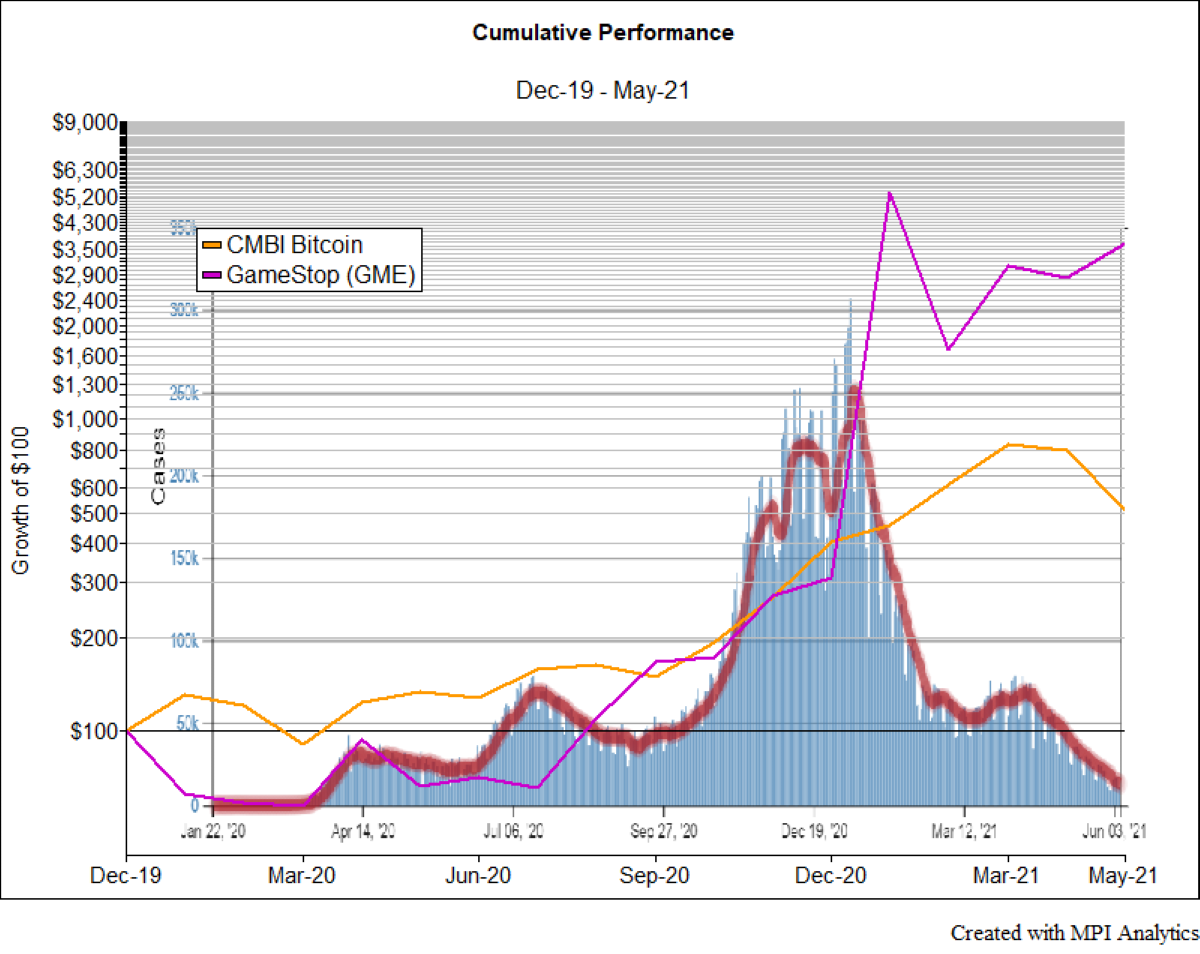

It’s been a wild rollercoaster ride these days for Bitcoin investors. The cryptocurrency hit an all-time high of $64k in April only to plummet nearly 50% a month later. Last year, as the entire world shut down access to mountain peaks and surfing spots, people started to look for stay-at-home ways to supply their adrenaline fix – and speculative trading fit the bill.

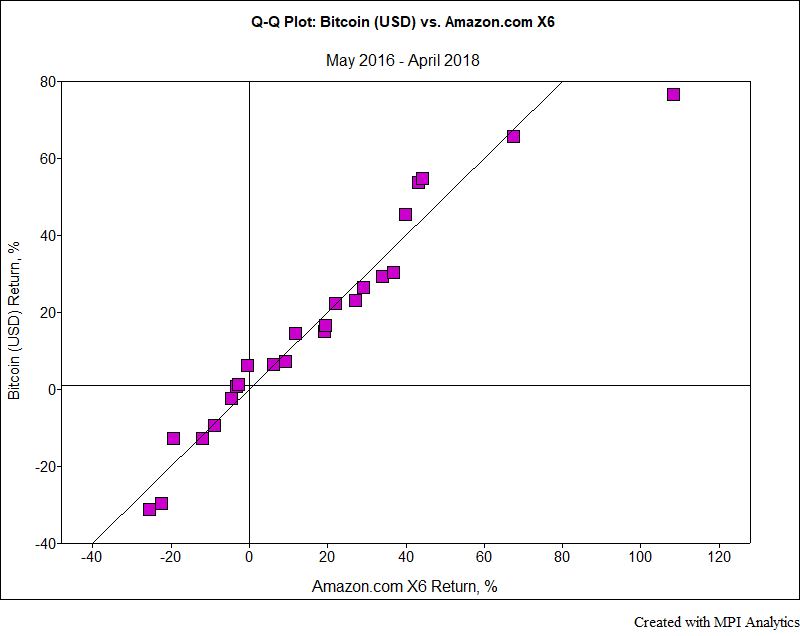

Bitcoin has had a spectacular year, with its price growing by 2,000 percent, topping out at nearly $20,000 before falling to a little over a third of that value. So, we posed the question to ourselves: how might investors have achieved Bitcoin-like returns over the last two years without needing Ambien to stomach the whipsaw swings in price?