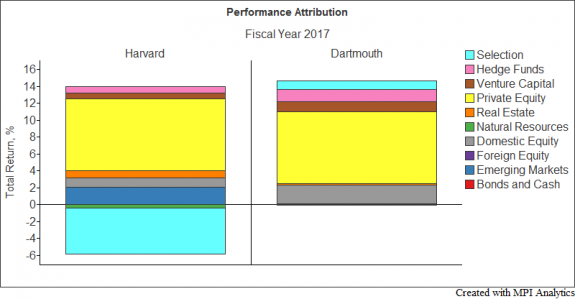

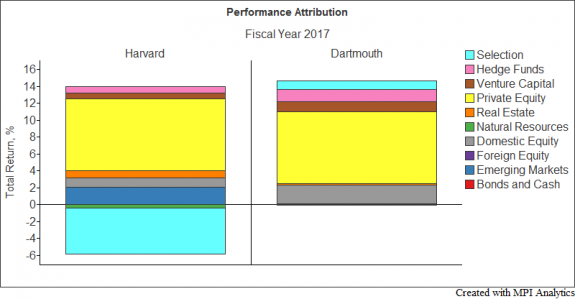

The returns of endowments can be attributed to two fundamental components: asset allocation and security selection. Asset allocation is what a factor model is generally able to explain, shown in terms of factor exposures.

The returns of endowments can be attributed to two fundamental components: asset allocation and security selection. Asset allocation is what a factor model is generally able to explain, shown in terms of factor exposures.

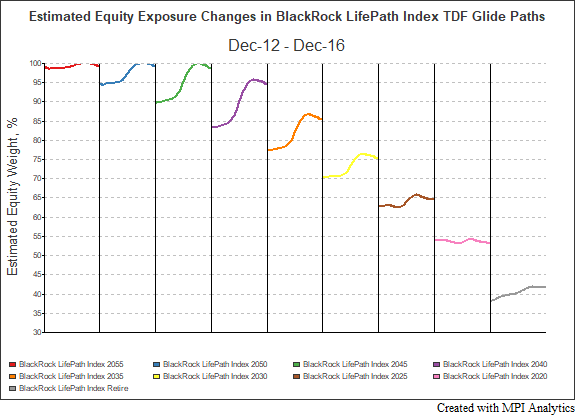

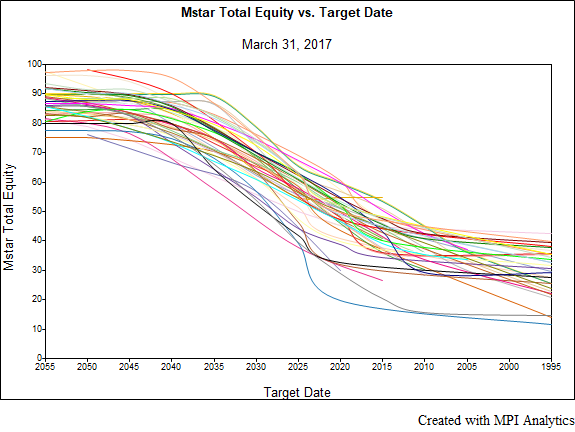

Morningstar’s 2017 Target Date Landscape Report indicates that approximately one quarter of TDF series shifted the target equity allocation of at least one vintage by 15% or more over the last 5 years and nearly half by at least 5%.

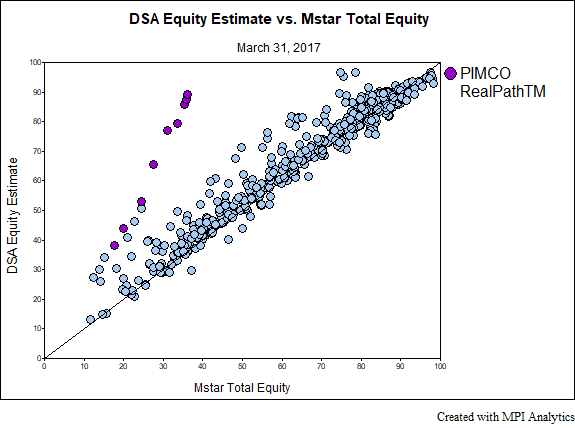

Four of the other five fund families with holdings vs. returns-based discrepancies are of a similar nature in that they have investments in derivatives, leveraged funds or absolute return funds, which affect the holdings tally. In each of these cases, DSA provides a much closer estimate to the intended systematic exposure.

We demonstrate the advantages of using returns-based analysis in determining the effective glide-paths of Target-Date Funds vs. the stated ones

This white paper looks at the period of the increased volatility in the financial markets leading up to and on November 8th and provides valuable insights into internal workings of risk parity strategies during periods of heightened volatility.

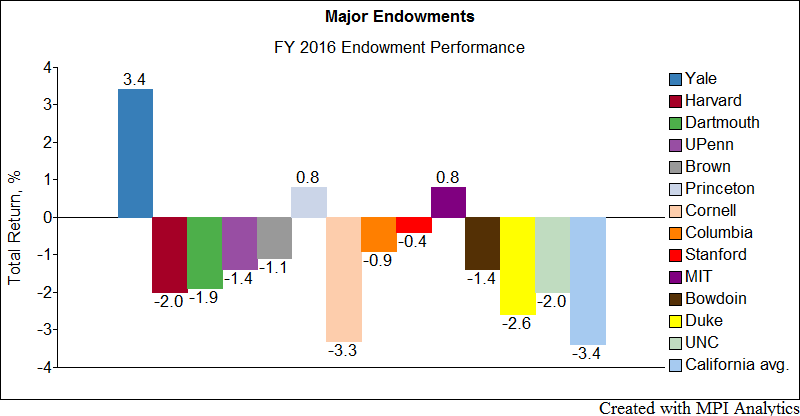

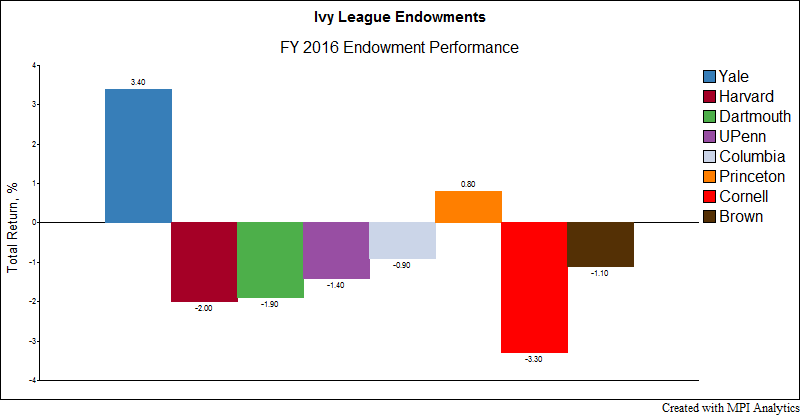

We look at the largest endowments and find striking similarities in their asset class exposures. At the same time, some endowments stand out both in terms of allocations and FY2016 performance.

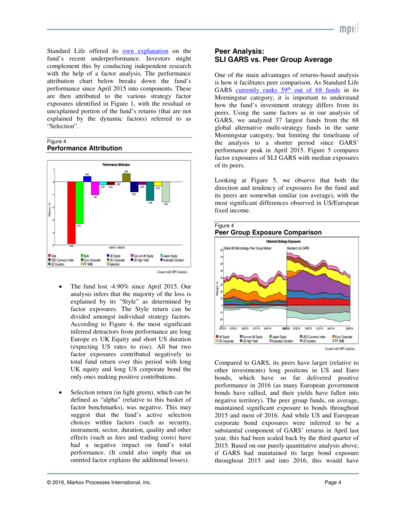

Using Standard Life Global Absolute Return Fund (SLI GARS) weekly performance data, we show how sophisticated factor analysis can provide valuable insights into this fund’s complex global “go anywhere” investment strategy.

An 1873 meeting that brought Harvard, Yale and Princeton together to codify the rules of American football also debuted a sports conference later known as the “Ivy League — eight elite institutions whose heritage, dating from pre-Revolutionary times, became formative influences shaping American character and culture. These schools also pioneered endowment investment management, thus helping to secure the nation’s educational legacy for posterity.

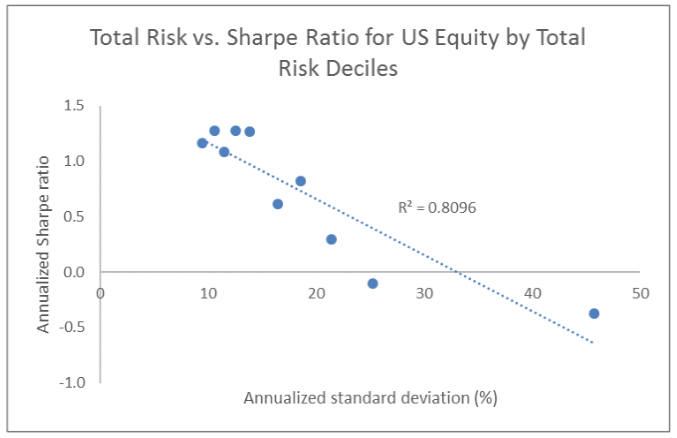

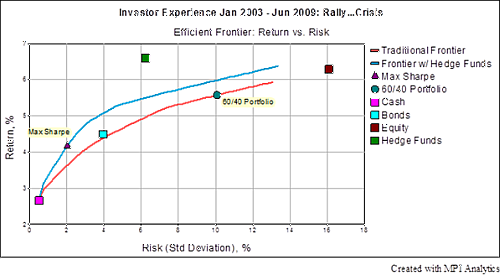

As the trickle of announcements about institutional investors exiting hedge funds became a steady stream, MPI decided to explore whether performance really justified an apparent growing disillusionment. Whereas much analysis and commentary to date had focused on the recent failure of hedge funds to beat the S&P 500 and other equity benchmarks, in our research we wanted to find out whether hedge funds had failed on their own terms.