Fund Research

Investment research solutions that deliver deeper insights and actionable intelligence, whether you are an investor conducting pre-allocation due diligence or a product developer looking to fine tune a new offering.

Manager & Fund Research

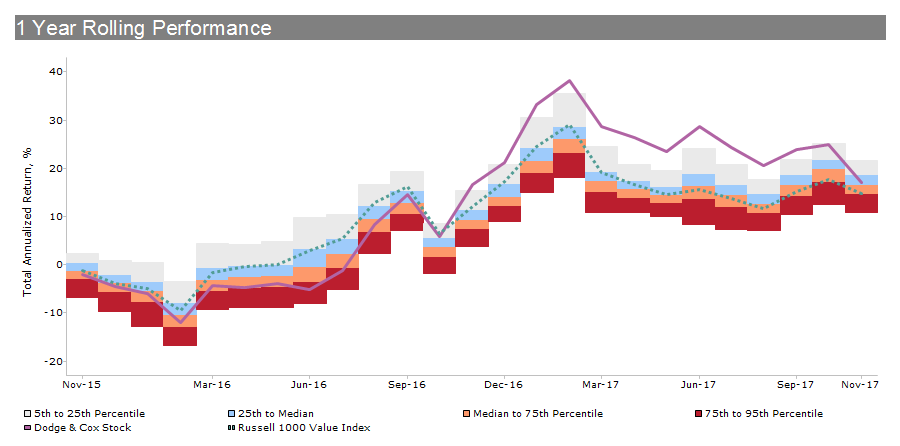

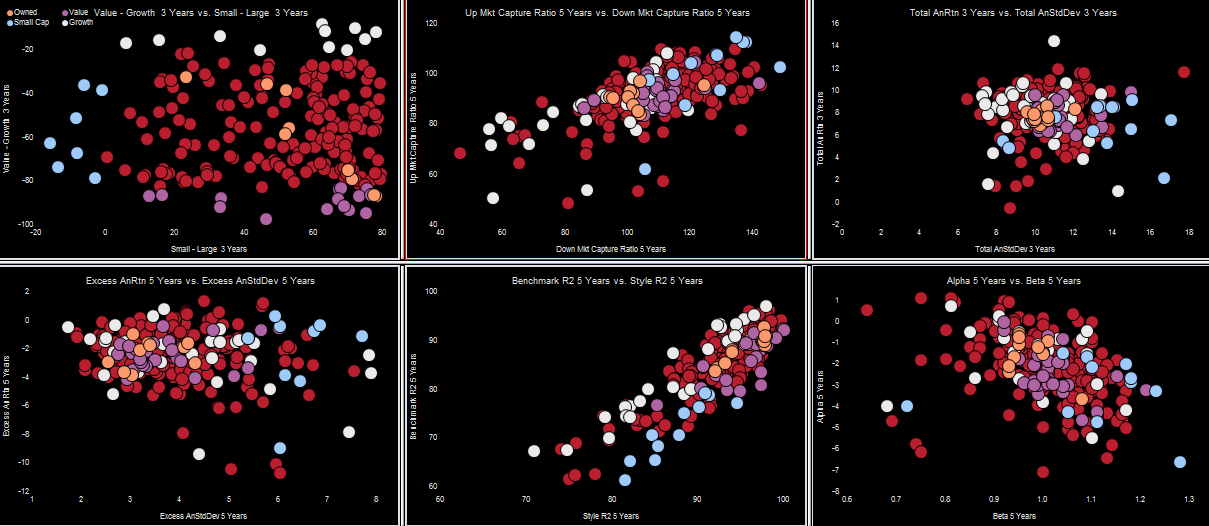

Investment research teams require robust financial technologies to efficiently deliver high-quality research and perform due diligence across a wide array of investment products. MPI Stylus suite of solutions equip research groups with powerful tools that accelerate investment analysis and drive smarter investment decisions.

Peer Group Research

Easily parse large fund peer groups and universes to identify the products with performance and exposure characteristics that meet your specific criteria. Institutional investors, consultants and advisors leverage our solutions to select and monitor managers and products with greater precision, speed and clarity. Product development, marketing and sales professionals within asset management firms use our solutions to identify opportunities for new product development and better position their offering against the competition.

Hedge Fund Research

Hedge funds employ diverse strategies and provide limited transparency into portfolio holdings, making insightful research and analysis difficult. Hedge fund analysts must understand a fund’s strategy, identify the risks, quantify the leverage being used, detect short exposures and identify indications of fraud. MPI Stylus suite of solutions provides the tools needed to address all of these needs.

Stylus Pro for Investment Research

Our flagship application, Stylus Pro is our most advanced solution. Comprised of four distinct modules―Stylus, Prospector, Allocator, Integrator―and delivered as a desktop application, Stylus Pro provides a comprehensive, quantitative solution to meet your investment research, analysis and reporting needs.