Your Equity Fund Might Hold More (or Less) Cash Than You Expect

We use our Stylus Pro system’s patented Dynamic Style Analysis (DSA) with daily fund data to determine whether U.S. equity mutual funds have substantially decreased market exposure in the highly volatile period from early-February to mid-March

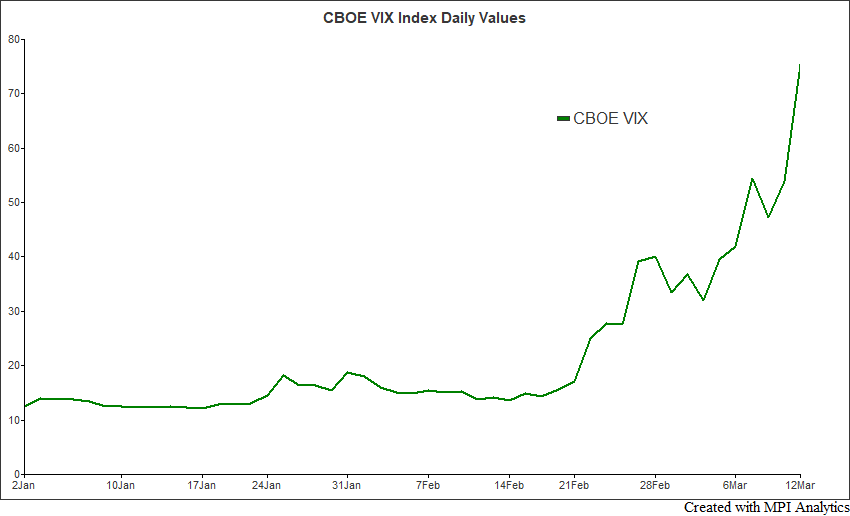

The past few weeks have been very challenging for all of us. As we navigate the news cycles and aim to keep our information intake at a healthy level, it is important to stay focused and calm during turbulent times. Likewise, when investors are faced with increasingly high stock market volatility, it is often prudent to de-risk. However, for most mutual fund managers a significant sell-off or hedging of core assets is not acceptable as such practices are typically outside funds’ prescribed mandates. As market volatility shot up in February and March (as measured by VIX in the chart above), most active Large-Cap U.S. mutual funds appear to have remained nearly fully invested and witnessed their portfolios losing between -10% and -30% over the past month and a half (vs. -15.7% for S&P 500 Index).1

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.