University of Chicago’s Endowment FY2022 Risk Premia Story

MPI Transparency Lab Analyst Commentary

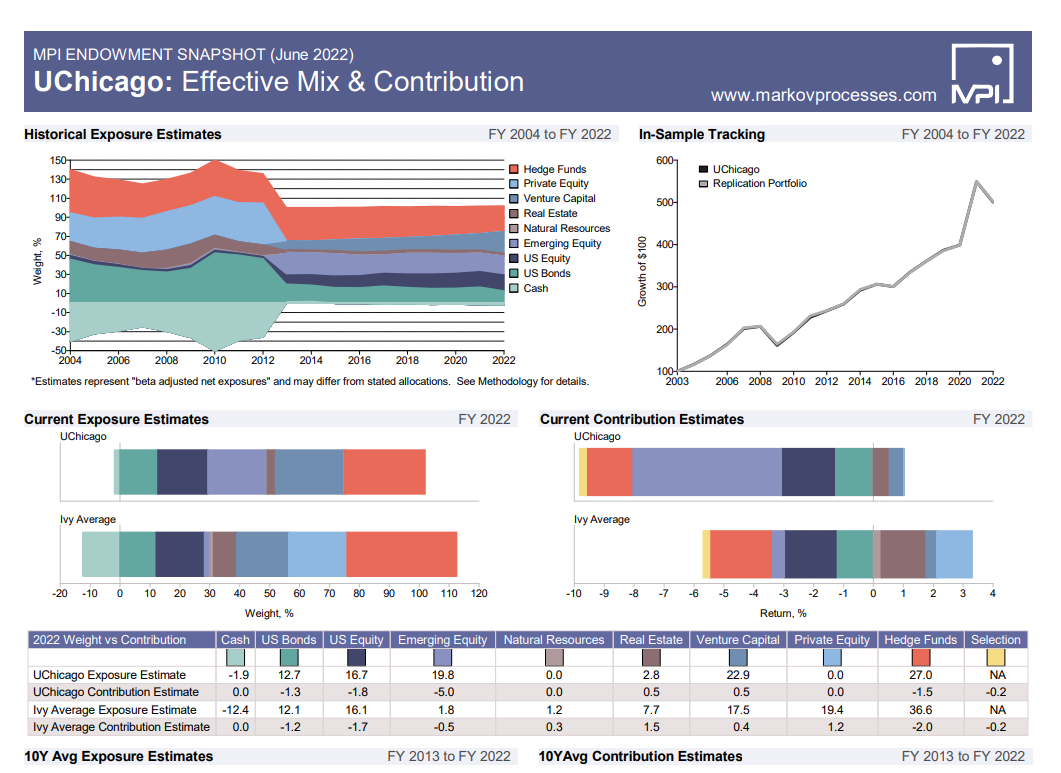

The $10.3B University of Chicago’s endowment beat the Ivies on a 10-year basis in 2013 (10% vs. 9.4%, respectively) but has since seen a steady relative decline. It posted a FY2022 loss of -8.8%, double that of the NACUBO $1B+ category (-4.46%), and it now underperforms the Ivies at 7.48% over the trailing 10 years (versus 10.8% for the Ivies.)

Our analysis shows that endowment exposures appear to have changed dramatically (beginning circa FY2012):

- The endowment moved to more liquid risk premia, away from less liquid positions.

- Overall derisking took the endowment to almost zero implied leverage.

- Private equity exposure decreased by half and appeared to be more of a growth or venture-capital style model.

- Emerging market exposures increased significantly vs. corresponding significant drops in real assets exposures.

The primary driver of poor performance in FY2022 was overexposure to emerging market equities (the worst-performing asset class) and underexposure to real assets and private equity (the best-performing asset classes). This continued a trend over the past ten years of less liquid asset classes outperforming more liquid ones, resulting in the endowment’s current situation.

MPI’s report is based on an analysis of the public annual investment returns of the endowment and does not reflect actual holdings or positions of the portfolio. For more information, download the free MPI360 report on University of Chicago endowment from the On Demand section of the MPI Transparency Lab.