North American Equity-USD Denominated Funds

Given the large number of North American Equity funds registered for sale in Europe, the analysis is divided into USD denominated funds and all other remaining funds. This month we examine USD funds and attempt to rank the managers’ performance based solely on their skills, thereby stripping away any beneficial or hurtful effect of currency […]

Given the large number of North American Equity funds registered for sale in Europe, the analysis is divided into USD denominated funds and all other remaining funds. This month we examine USD funds and attempt to rank the managers’ performance based solely on their skills, thereby stripping away any beneficial or hurtful effect of currency movements and improving the returns-based style analysis (RBSA) results. Next month, our asset class focus will be on North American Equity funds denominated in EUR. Click here to download the PDF.

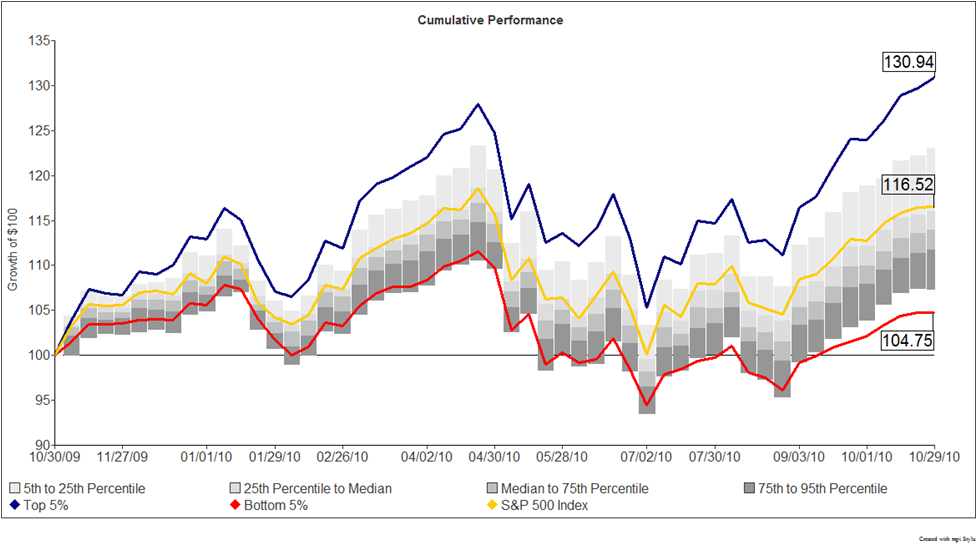

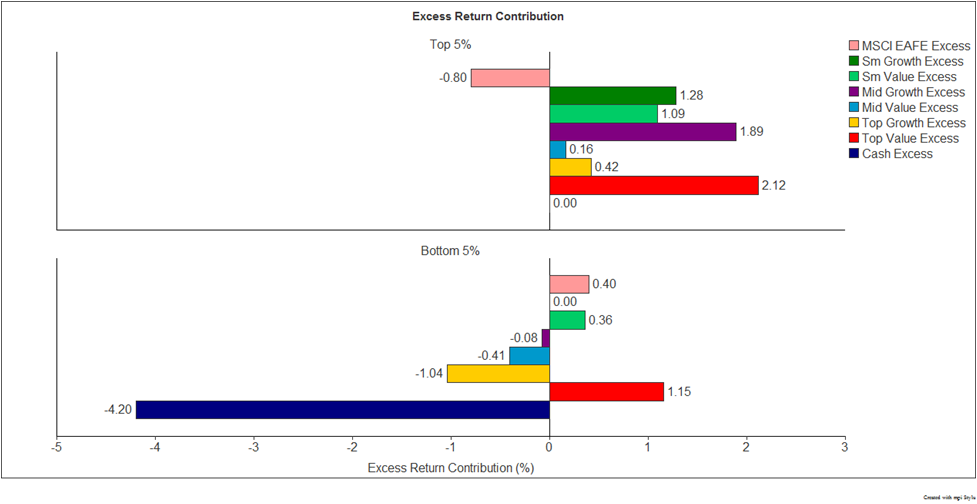

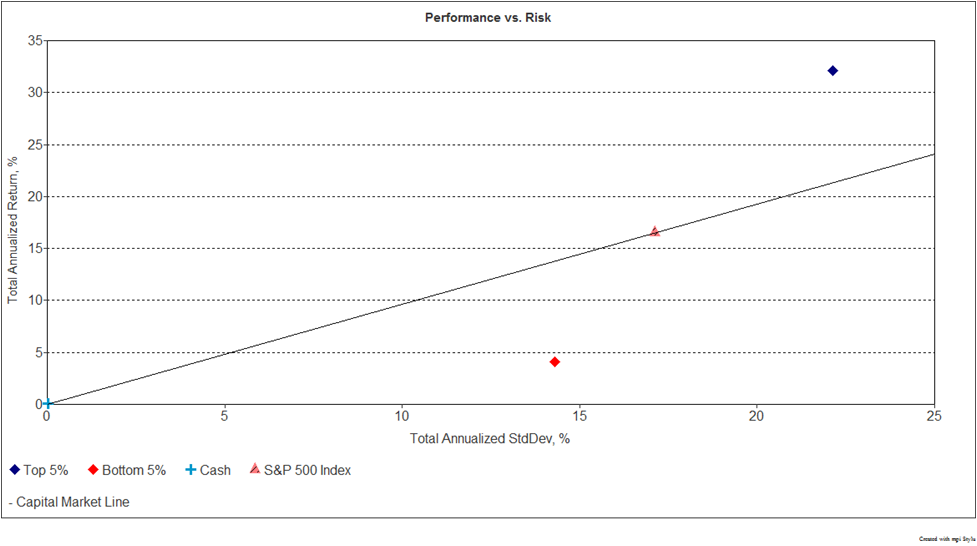

North America Equity funds’ performance ranges from about 10% to 45% over the last 52 weeks (ending October 29, 2010). This disparate performance allows for the best 5% of the funds to outperform the market (pegged to the S&P 500 Index) by approximately 15% and the worst 5% underperforming by approximately 12%.What role do favourable style allocations play? We take a closer look at common factors describing the best and worst funds on an aggregate basis. When funds are aggregated in a group, their common factors crystallize and specific bets are diversified away, which provides the basis for such an analysis. Our analysis suggests that the top- and bottom-performing funds, on average, invested in quite different industries which impacted their performance. Top-performing funds benefited from selection and timing, mostly impacted by overweighting their exposures to top and mid growth. The worst performers were negatively impacted by having high exposure to cash and international equity (proxied by the MSCI EAFE Index) while underweighting their exposure to growth. Using an attribution framework, we were able to quantify the impact of each bet on the overall performance. Please note that our conclusions may change if a different timeframe is used to select the best/worst funds.

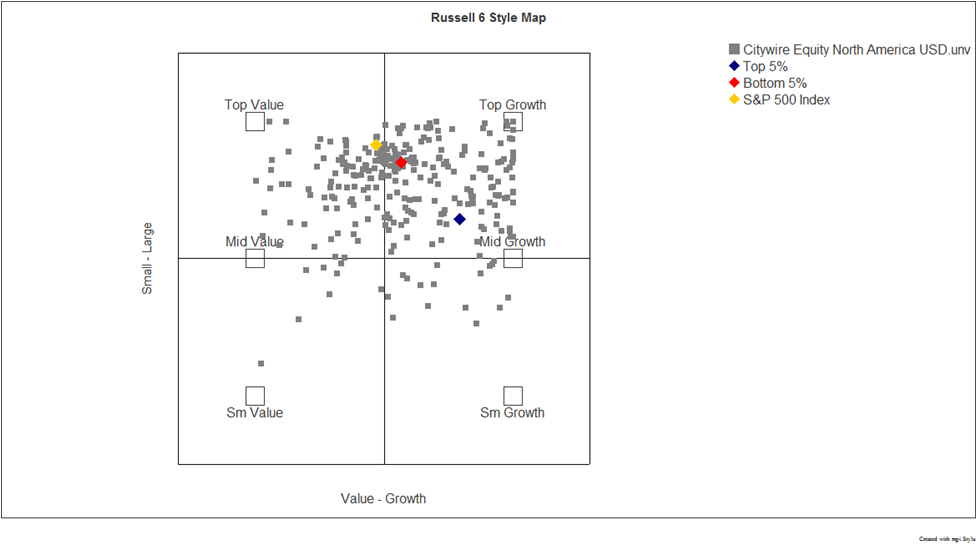

Universe Overview – RBSA Analysis

– The universe is comprised of 287 funds that are classified under Lipper Global: Equity North America, with AUM of at least USD $10 million and denominated in USD. Our analysis takes into account the performance of the Primary Share Class, as defined in Lipper Hindsight.

– RBSA analysis of the universe suggests that slightly over 72% of the funds have a cash exposure of 10% or less; however, the exposure to cash tends to be higher for the lowest ranking funds.

– The best performing funds have a larger standard deviation than the worst performing funds; however, it is still in line with the majority of the mid-ranked funds in the universe.

– RBSA average exposures to different style/capitalization factors, over the past 52 weeks, the funds in the universe are mostly tilted towards Large Caps.

Selection of Top/Bottom Fund Groups

– Based on the universe of 287 funds, the total annualized performance is calculated during the last 52 weeks to rank the funds. Using the top 5% (13 funds) and bottom 5% (15 funds) equally weighted, daily rebalanced portfolios are created to try to understand why, on average, one group performed better in terms of style exposures.

– As shown below, not surprisingly, the top 5% of funds outperform its peers, benchmark and bottom 5%. Over the analysis period, the top 5% group returns approximately 16% above the S&P 500 Index while the bottom 5% group returns 12% below the index.

Returns-Based Style Analysis Highlights

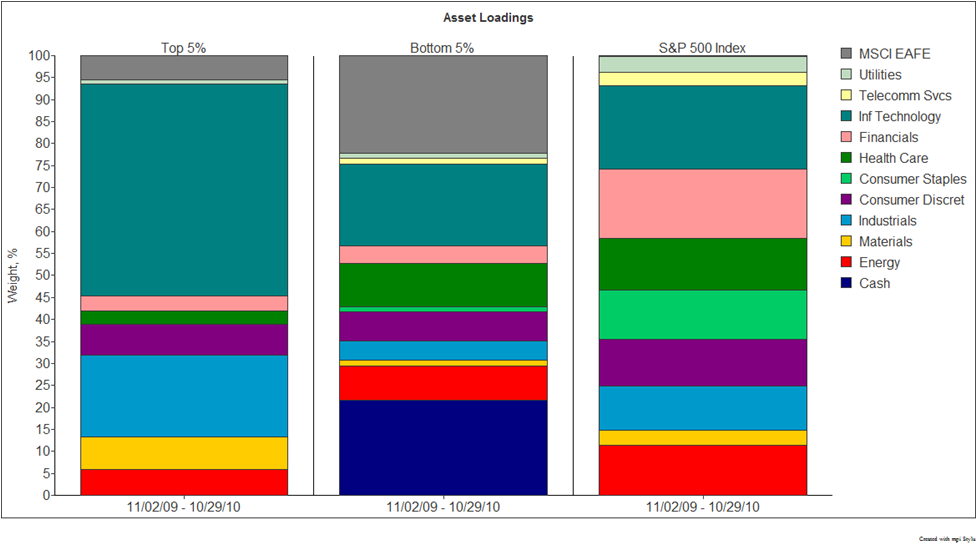

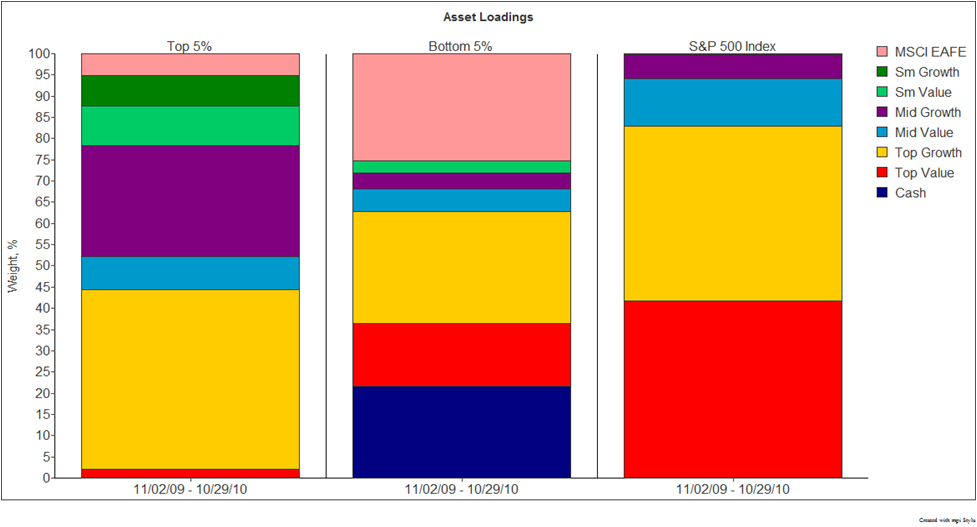

– Using Style Capitalization factors, the first RBSA analysis demonstrates that the top 5% funds are fully invested, with significant style exposures to growth —a category dominated by technology firms. At the same time, the bottom funds’ behaved as if holding large amounts of cash with large exposure to large cap value and growth, as well as exposure to international equity.

– The second analysis, focused on Sector Analysis, shows that the top 5% of funds are exposed mostly to information technology and industrials, sectors in which they are overweight as compared to the benchmark. The top 5% overweight MSCI EAFE, IT, industrials, and materials and underweight the remaining sectors. On the contrary, the bottom 5% are mostly exposed to cash and MSCI EAFE, sectors in which they are overweight vs. the benchmark.

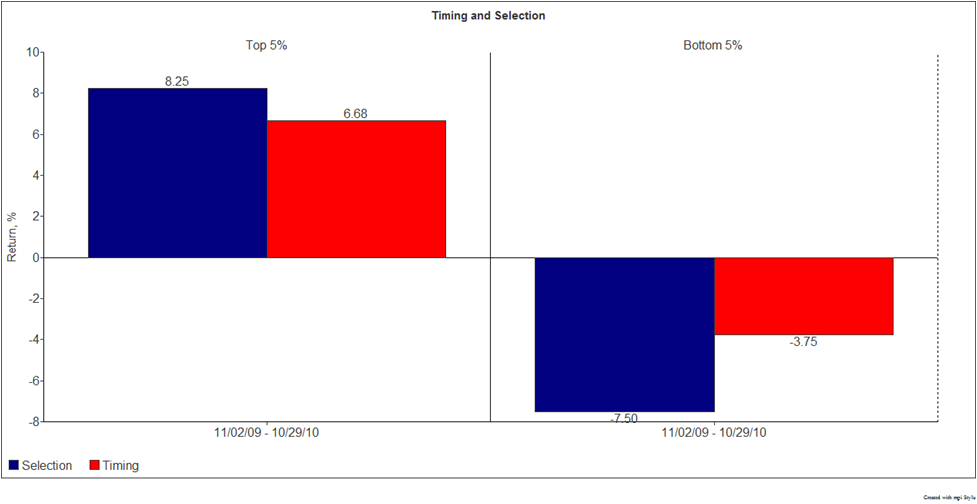

– As a group, the top 5% display strong selection and timing skills, whereas the bottom 5% show negative selection and timing. Selection and timing returns represent components of excess benchmark performance.

– Attribution analysis can clarify if decisions to over- and under-weigh different styles (vs. the benchmark) aided or hurt the funds. For the top 5%, the overexposure to top and mid growth and underexposure to top value benefit the funds. The bottom 5% decision to be exposed to cash and underweight in growth clearly hurt them. Although both top and bottom funds have positive exposures to international equity, which the benchmark does not, the effects are different. For the top funds, the exposure to MSCI EAFE is less than 10% and was positive for the first half of the analysis period. The bottom funds’ exposure has consistently been over 12%, going over 30% for the second half of the analysis. The different behaviours allow for the attribution to be negative for the top and positive for the bottom funds.

– As expected, the diversification effects of blending a large number of funds together in an equally-weighted portfolio results in very high explanatory power for both analysis with R-Squared values of slightly over 96% for the top 5% and 85% for the bottom 5%.

Rolling Risk/Return Analysis

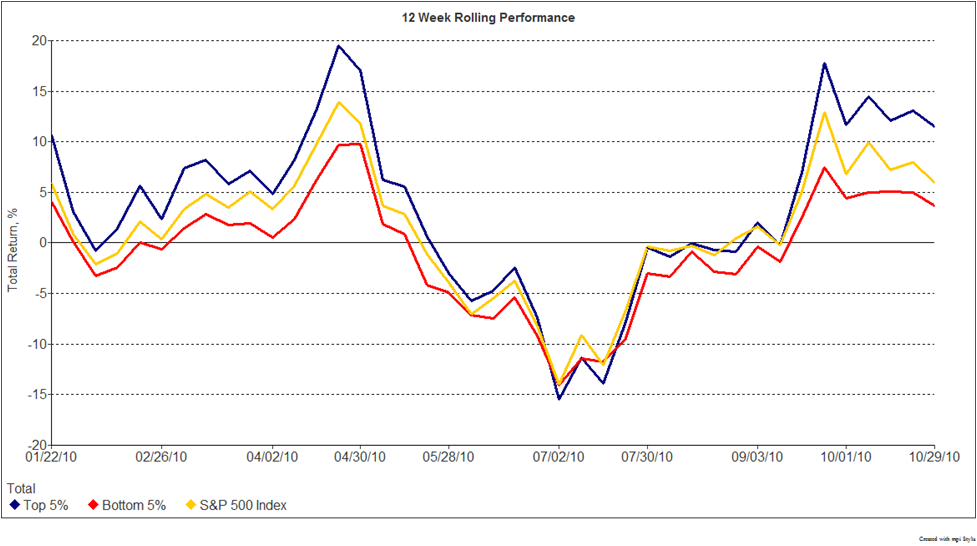

– The chart below shows that over the analysis, the top 5% had periods, on a 12-week rolling basis, of strong over-performance (vs. the benchmark). During Q3 2010, the top 5% (slightly) underperformed the benchmark, and even the bottom 5% funds. Over the past 6-8 weeks, the top funds reclaimed some lost ground. On the other hand, the bottom 5% underperformed the benchmark for most of the period of analysis, although in the first few weeks of July 2010 they appeared to be tracking it very closely.

– The top 5% display higher risk than both the benchmark and the bottom 5%, as defined by the 12-week rolling standard deviation. The bottom 5% have much lower risk which reflects the overexposure to cash. The higher risk of the top 5% has clearly paid off, as they generated over 2 units of return per unit of risk, as measured by the Information Ratio of 2.61.

– On a risk-adjusted basis and comparing the funds with the Capital Market Line, the top 5% portfolio provides a higher return per unit of risk than the benchmark. The bottom 5% are clearly not producing an adequate level of return for the risk they are exposed to.

UNIVERSE DEFINITIONS & ASSUMPTIONS

- Database provider: Lipper, a Thomson Reuters Company

- Registered for sale countries: Austria, France, Germany, Italy, Netherlands, Offshore, Spain, Sweden, Switzerland, and the UK

- Filters: share class, at least 1 year of performance history, Asset Type: Equity, Geographical Focus: North America, Lipper Global Category: Equity North America, AUM: minimum USD 10 Million, Denominated in USD

- Number of funds analyzed: 287

- Date interval: Last 52 weeks starting on November 2, 2009 and ending on October 29, 2010

- Currency: USD

- Analysis Frequency: Weekly (with compounded daily data)

- Cash proxy (Risk Free Rate): Merrill Lynch 91 day T-Bill Actual Price Index

- Benchmark: S&P 500 Index

- Style factors: Russell 6 Indices: Top 200 Value and Growth, Mid Cap Value and Growth, and Russell 2000 Value and Growth; MSCI EAFE; S&P 500 Sector Indices – Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Information Technology, Telecommunication Services, and Utilities.

- Analysis performed with mpi Stylus Pro™

Style Return: Return of the Best Fit Portfolio for the Manager Series, where the holdings of the portfolio are the Style Indices.

Selection Return: Calculated as the Manager’s Return subtracted by the Style Return. This is an indication of the Manager’s Selection or Stock Picking abilities.

Timing Return: Calculated as the Manager’s Style Return subtracted by the Benchmark’s Style Return. This indicates whether the Manager’s decisions, to over or under weight the style holdings, as compared to the benchmark, added to the portfolio’s return or not.

Style R Squared (R2): Measure of the model’s power in describing the Manager’s past behaviour in terms of style. The higher the Style R Squared value, the better the model’s explanatory power.

Predicted Style R Squared (PR2): Measure of the model’s power in predicting the Manager’s future behaviour in terms of style. The higher the Predicted Style R Squared value, the better the model’s predictive power.

Style Map: Graphic representation of the results of the Style Analysis. The series being analyzed are mapped unto a Cartesian plane, in which the X and Y axis represent exposures to different Styles and Sizes.

Asset Loadings: Weights of the Style Indices, as holdings, of the Style Portfolio, as calculated by mpi Stylus Pro.

——————————————————————————————————————————-

Markov Processes International, LLC (MPI) is a global provider of investment research and technology solutions. MPI’s analytical tools and methodologies are employed by the finest institutions and financial services organizations to enhance their investment research, reporting, data integration and content distribution. MPI offers the most advanced platform available to analyze hedge funds, mutual funds, portfolios and other investment products, as well as asset allocation and portfolio optimization tools.

MPI’s Stylus Pro software is utilized by alternative research groups, hedge fund of funds, family offices, institutional investors, consultants, private banks, asset managers, diversified financial services organizations as well as marketing, product development and IT departments around the world. MPI also offers solutions for investment advisors and private wealth professionals. For more information on past MPI research articles visit https://webdev-new.markovprocesses.net/company/research.htm