Is Columbia’s Endowment Performance at the Top or the Bottom of the Ivies? It Depends.

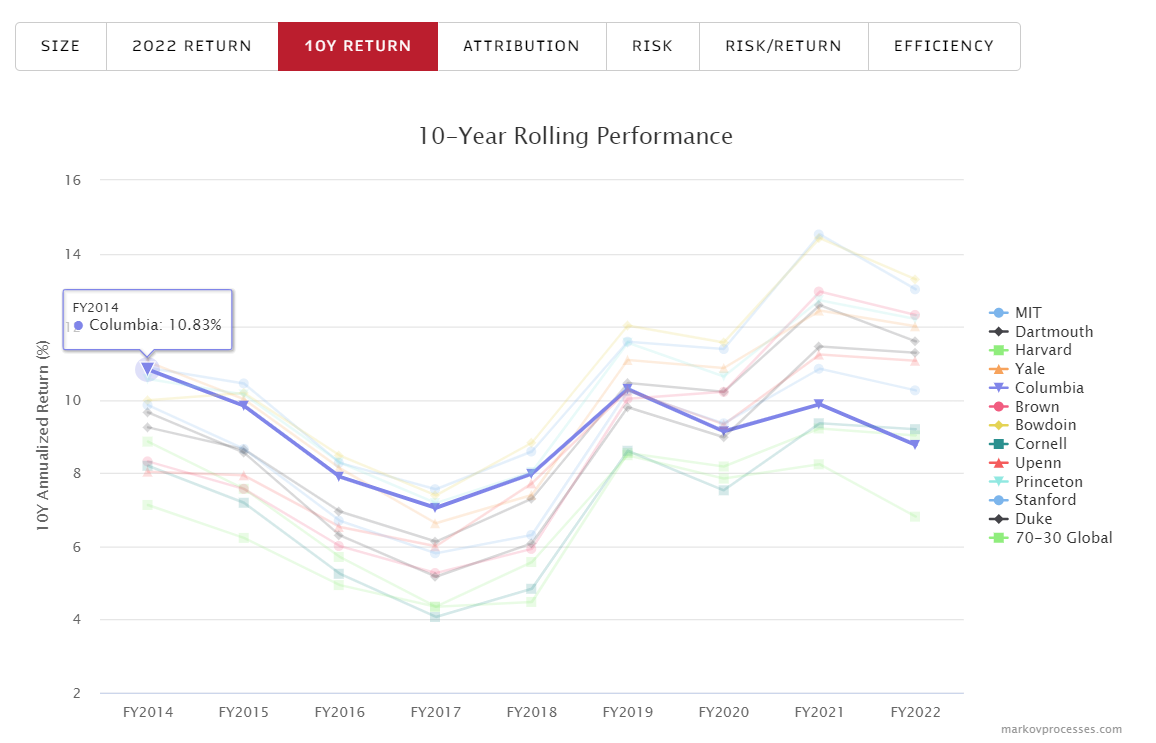

About eight years ago, Columbia University’s endowment had a 10-year return that was one of the best in class, together with MIT and Yale.

About eight years ago, Columbia University’s endowment had a 10-year return that was one of the best in class, together with MIT and Yale.

This past year, Columbia found itself at the very bottom, with a trailing 10-year return of just 8.8%.

That put the focus on whether Columbia’s Investment Management Company, run by CEO Kim Lew, need a change in focus or strategy.

It is easy to criticize endowments solely on returns. After all, despite their importance, there is so little data made available about them. What’s more, performance data is only released typically once a fiscal year.

We have already written about the falling endowment angels, but the story of performance in endowments can be far more nuanced. As our recently launched MPI Transparency Lab helped us to discover, Columbia may be at the bottom of 10-year performance, but it is doing far better in other metrics, which is important to all of its stakeholders.

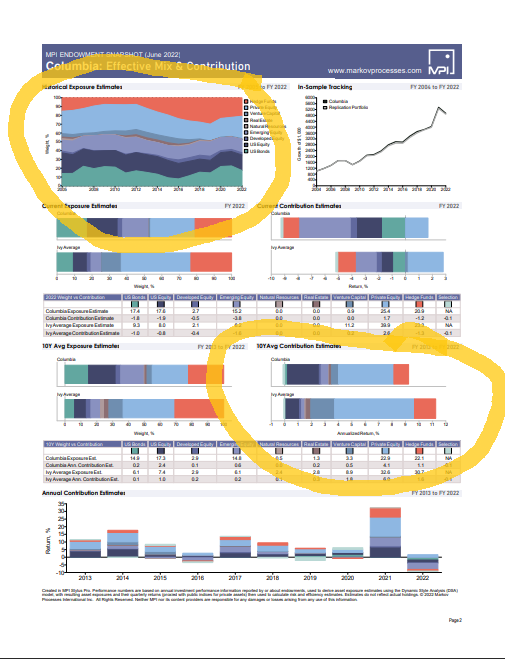

First, it’s important to see why Columbia has fallen so far from a pure performance basis. Our detailed endowment 360-reports (available to be downloaded free at the Lab) provide all the necessary reasons. First, we derived asset class dynamic exposures from quantitative analysis of public annual endowment returns. We then used these exposures to compute both performance and risk attribution and compare it across the peers. In the case of Columbia, our report shows that the endowment had lower exposure to private assets and VC, and in recent years had dramatically increased exposures to risk-mitigating assets such as hedge funds and bonds. This led to their loss versus other Ivies, which have been increasing their allocations to private equity and venture capital – the two highest-performing asset classes.

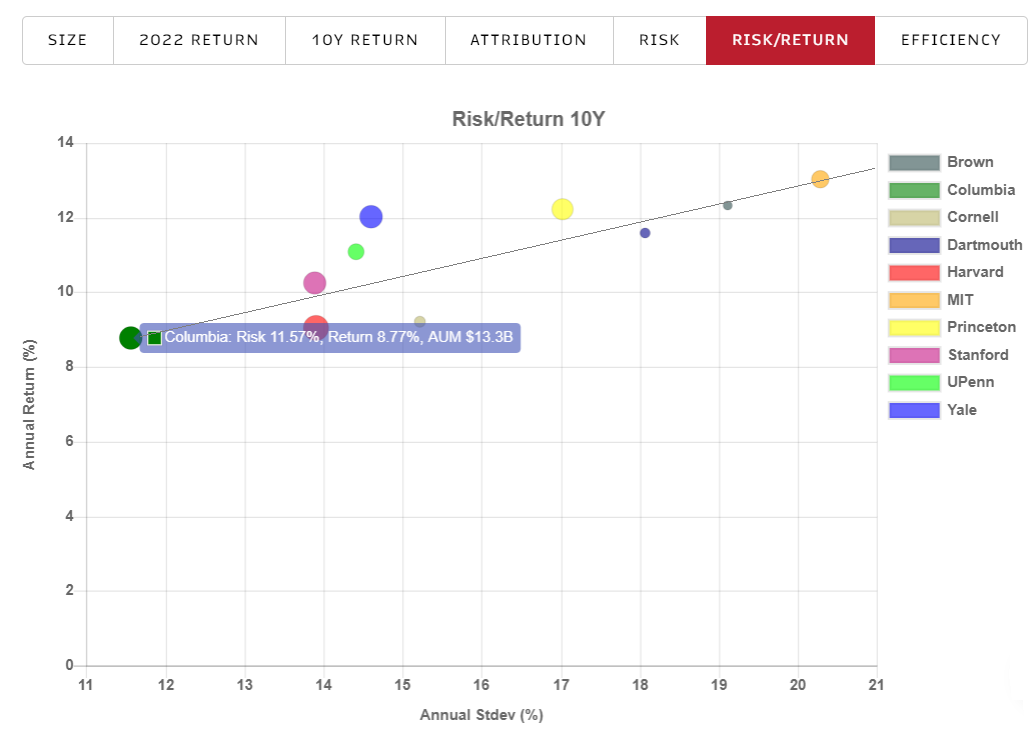

But as our Lab shows, there’s another number worth focusing on. Columbia’s 10-year risk estimate of 11.6% (annual standard deviation) is the lowest of the group, and almost half of the risk of the best-performing endowment (MIT; 20.3% estimated annual standard deviation).

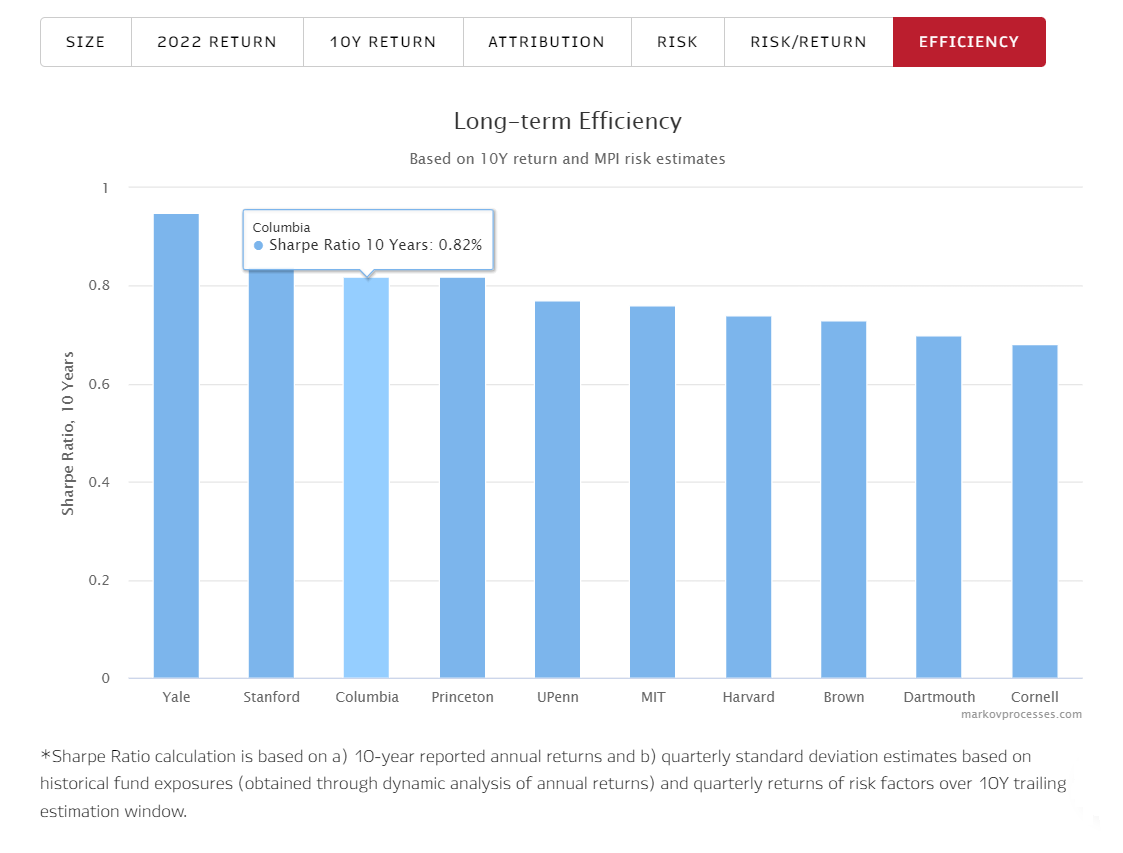

What does this mean? Well, this immediately propels Columbia to tie with Princeton for second place among the Ivies when it comes to efficiency, as measured by Sharpe Ratio (not counting Stanford University, which is included in our Lab, but is not an Ivy).

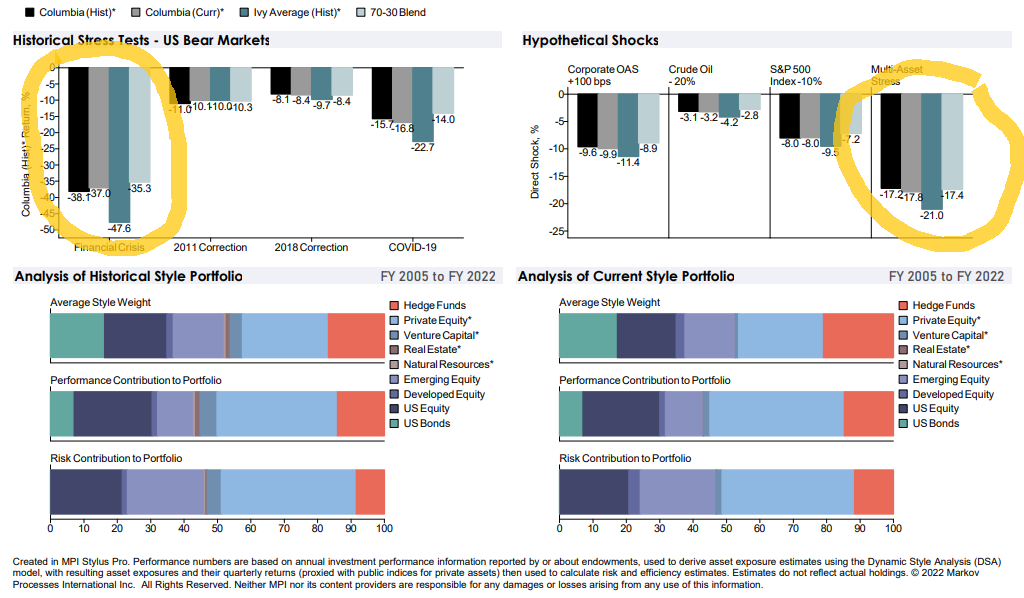

This also means that, given its risk exposures, Columbia’s endowment has much lower risk than other Ivies, whether it’s a historical stress test or a hypothetical multi-asset shock.

This is not the first time we highlighted the risk-mitigating strategy of Columbia’s IMC. In our 2018 CAIA paper, “Alpha and Performance Efficiency of Ivy League Endowments: Evidence from Dynamic Exposures,” we noticed that through the 2017 fiscal year, the endowment occupied the top spot among Ivies in efficiency.

In an era where stakeholders are complaining about transparency – and with good reason – there is some useful information to be found for those willing to look for it. It completely can change your point of view on endowments for your own universities.

We’ll continue to highlight our findings as we come across them but invite you to see how your endowment fared in the MPI Transparency Lab today.