“Go-Anywhere” Bond Fund Bets Finally Seem To Be Paying Off

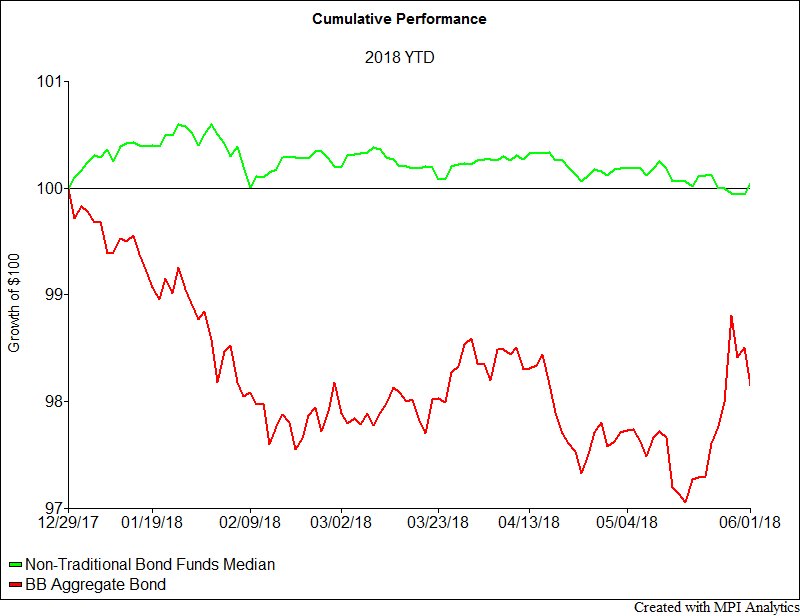

After years of underperformance following the financial crisis, the non-traditional bond fund segment is beginning to shine, outperforming the broader market index in the face of rising rates.

April and May’s testing of the symbolic 3% yield threshold for 10-year Treasuries triggered a wave of headlines cautioning against fixed income mutual fund losses. And, for the most part, those concerns were warranted. The Bloomberg Barclays U.S. Aggregate Bond Index, fell almost -3% year to date in May, but rallied to end up down only -1.85% for the year as of June 1st.

There’s one group of bond funds, however, whose investors are more than happy to see the Fed’s rising rates regime finally hit its stride: non-traditional bond funds. These funds have seen a significant uptick in performance since we last wrote about them in 2015.

Sign in or register to get full access to all MPI research, comment on posts and read other community member commentary.