Fiscal Year 2023 Pension Roller Coaster

MPI Transparency Lab projects a complete reversal of FY2022 results for U.S. public pensions with last fiscal year’s winners projected to have low single digit returns in FY2023. Funds are lagging due to their exposure to poor performing private equities and commodities and winning because of exposure to global equities.

MPI Transparency Lab projects a complete reversal of FY2022 results for U.S. public pensions with last fiscal year’s winners projected to have low single digit returns. Funds are lagging due to their exposure to poor performing private equities and commodities and winning because of exposure to global equities. Projected winners are teachers’ retirement systems of Georgia, Kentucky, Oklahoma and New York, public employee retirement system of Mississippi and LACERA. Oregon, Washington and Pennsylvania state PERS are projected to trail other funds. The median FY2023 return for the group of 40 large state pensions is 9.0%, which is lower than the 9.4% return of the Global 60-40 benchmark.

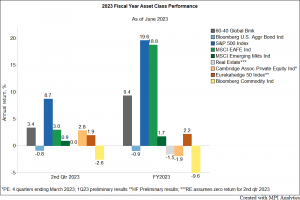

With most pensions and endowments reporting their results only once a year, outsiders rarely have an appreciation of their intra-year volatility. Our recently launched MPI Transparency Lab fills this gap by providing quarterly estimates of pension performance immediately after the quarter end. Our estimates are based on the 2022 fiscal year asset class exposures which we derived from annual pension returns, and asset class returns for four quarters of 2023 fiscal year (ending June 2023). Asset class performance for the second quarter of 2023 and the entire 2023 fiscal year (four quarters ending June 2023) is shown in chart below.

Because public funds use a quarter lag in valuation of private equity portfolios, for our estimations we used PE index performance for 12 months ending March 2023. Performance of the Global 60-40 benchmark for FY2023 was 9.4% driven primarily by U.S. and ex-U.S. equities (19.6% and 18.8%, respectively) with bonds returning -0.9%. Private equity, real estate, and commodities all had negative returns for the fiscal year leading to significant underperformance of pensions with significant allocations in private equity.

Take, for example, the lowest estimated FY2023 performers in the group – state employees’ pensions of Oregon (1.8%) and Pennsylvania (2.9%). Interestingly, last fiscal year these pensions reported some the highest performance in the group as shown in chart below. Thus, Oregon PERS reported a 6.3% gain in FY2022 while most peers lost more than 5% and some lost even more than 10% over the same period.

In the attribution chart below, we show the contribution of asset classes to the total estimated return for the 2023 fiscal year. Contribution was negligible from private equity and bonds, while pensions with the highest exposures to global equity came out at the top. Teachers Retirement System of Georgia with 74% exposure to global equities is estimated to have the highest return in fiscal year in the group.

Our results may change slightly as we await updated data on Cambridge Associates PE and RE benchmarks (we used preliminary estimates) but we don’t expect any significant changes in projections.

Knowing how your pension is doing quarter by quarter not only serves to satisfy one’s curiosity. Rather it prepares beneficiaries so that they are not caught by surprise at the year-end by the results of their pension. However, we see the main value of the Transparency Lab in providing pension CIOs valuable datapoints about their narrow set of close peers.

Disclaimer

MPI projections of FY2023 performance are based on analytical analysis of past pension funds’ returns and, beyond any public information, does not claim to know or insinuate what the actual strategy, positions or holdings of the funds discussed are, nor are we commenting on the quality or merits of the strategies. This analysis is purely returns-based and does not reflect actual holdings. Deviations between our analysis and the actual holdings and/or management decisions made by funds are expected and inherent in any quantitative analysis. MPI makes no warranties or guarantees as to the accuracy of this statistical analysis, nor does it take any responsibility for investment decisions made by any parties based on this analysis.

Thank you for much-needed info. The last graph is hard to read. As a NJ PERS retiree, can you state the investment allocation percentages for our fund, and our postion vis-a-vis other states?

Thanks for you comment, Deborah. Our apologies for the lack of clarity. The chart you’re referring to is the (emphasis on) estimated return generated by each asset class for each pension, for the fiscal year ending June 30th, 2023. It should give those values for NJ PERS if you hover your mouse over your pension’s stacked column.

We do provide a number of individual pension reports in our transparency lab, including NJ PERS and the first page does have each pension’s self-reported asset allocation set against a visual distribution of other pensions’ allocations.

https://webdev-new.markovprocesses.net/product/mpi-transparency-lab/?tab=pensions

Best regards,

Megan

Hi Megan,

I am a teacher in Massachusetts with my pension being managed by Mass PRIM. Do you have any analysis on their performance, especially considering how they chose to commit an additional $3 billion in commitment to Private Equity during this downturn of the asset class given the rising interest rates?

Thanks,

Matt

Hi Matt,

thanks for your question. Mass PRIM manages both teachers’ and employees’ retirement funds and we do have both in our Lab. For that reason, their performance numbers are the same, but funding is different with TRS having lower funded ratio. In terms of risk, performance and efficiency they seem to be in the middle of the group. We, obviously, cannot comment on merits and the rationale behind their decision to allocate more to PE. Pension typically do this to improve their funded status as higher expected returns are being used to discount liabilities.

We are not consultants to provide investment advice, we’re a fintech company providing tools to some of the largest investors such as Mass PRIM to make informed allocation decisions when investing with individual managers including traditional equity and bond managers, hedge funds and private equity funds. The Transparency LAB is a public project where we use our tools and public pension/endowment data to provide free information to both professional allocators as well as private pension beneficiaries such as yourself. We hope that this project will lead to more transparency.